Generate your customised report with our free calculator for all to calculate end of service benefits in the Kingdom of Saudi Arabia.

A gratuity, sometimes referred to as end-of-service benefits (EOSB), is a financial incentive given to employees as a thank-you for their dedication and years of service to the organization. The Saudi Labor Law governs gratuities in the Kingdom of Saudi Arabia (KSA) and specifies the duties and rights of employers and employees. Usually, this sum is paid out after an employee’s job ends—either by resignation or termination.

| Resignation | ||||

| Particulars | ||||

| Date of Joining | ||||

| Last working day | ||||

| Service Days | ||||

| Service Years | ||||

| Total Salary | ||||

| One Day salary (Salary/30) | ||||

| Gratuity Eligibility | ||||

| Gratuity Days | ||||

| First 5 Year of Service | ||||

| From 6th Service onwards | ||||

| Total Gratuity | ||||

| Gratuity Amount | ||||

According to Saudi labor law, the employee’s entitlement to Gratuity is calculated based on the type of separation and years of service.

If the employee resigns, he is entitled to the gratuity after working for the same organization for two years. On the other hand, if the employee is terminated, he is entitled to receive a gratuity for working more than a year in the same company.

The gratuity calculator in KSA is a specialized tool designed to help both employees and employers determine the end-of-service benefits (EOSB) that an employee is entitled to receive upon the termination of their employment. This calculator guarantees accuracy and complies with Saudi Labor Law while simplifying the gratuity process.

The gratuity calculator considers a number of variables, including the employee’s base pay, length of service, and the cause of termination (e.g., resignation or employer termination). The calculator estimates the amount of gratuity owing to the employee based on the information entered.

The following details are often required to utilize a gratuity calculator:

After this data is entered, the calculator estimates the gratuity amount by processing the information in accordance with the Saudi Labor Law’s regulations.

The amount of gratuity can be influenced by various factors, especially the reason for the end of the employment relationship. The sum payable is defined under Articles 85 and 87 depending upon the reason for separation: resignation or termination of employment

According to Article 85 if service tenure is:

According to Article 85 if service tenure is:

Exceptions: No matter how long they worked, an employee is entitled to a full gratuity under Article 87 if their employment is terminated owing to a circumstance beyond their control.

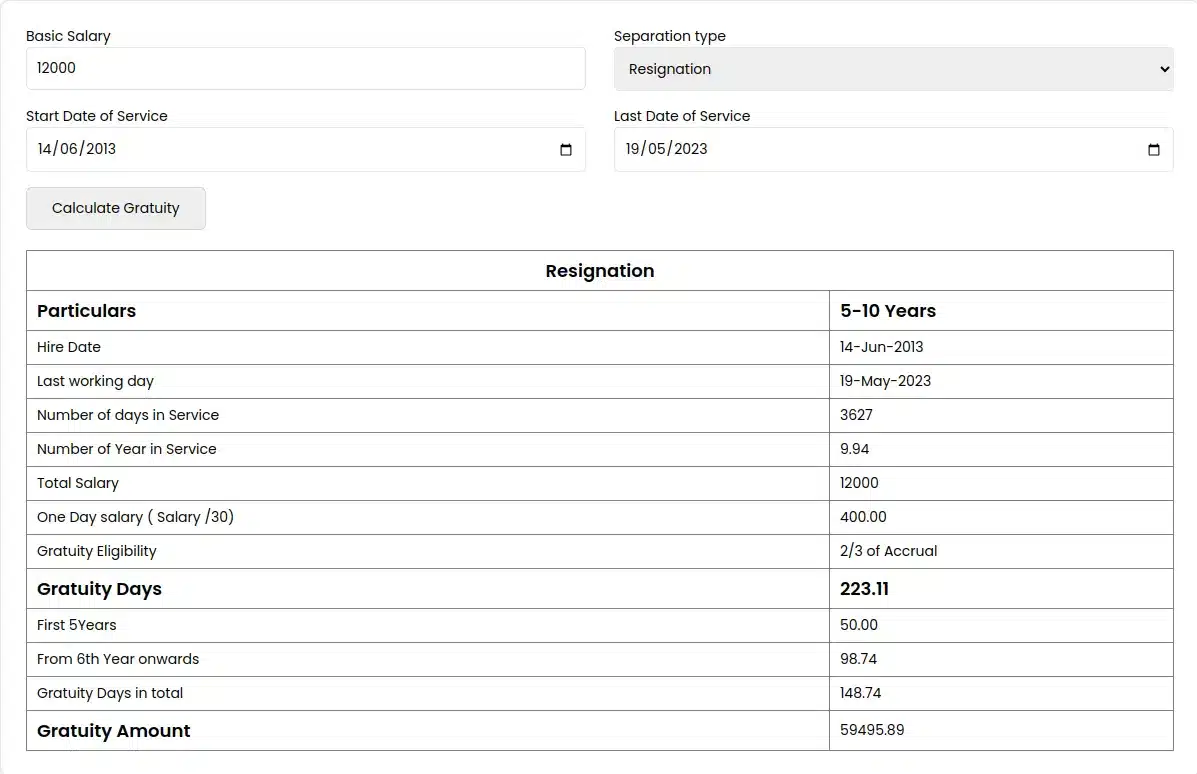

To help you understand how the gratuity calculator in KSA works, there is an example below to have a clear understanding:

For example, if an employee resigns on 19th May 2023 and at that time the basic monthly salary was 12000 SAR. The start date of the service of the employee was 14th June 2013, thus making the length of the period of service between 5-10 years.

The gratuity for the employee can be calculated as below:

If a female employee terminates her employment within three months of giving birth or six months of getting married, she will also be eligible for the full payment.

When an employee’s employment comes to an end—either through resignation or termination—a gratuity is paid as part of the overall settlement. According to their duration and the terms of their departure, the payout is done.

After working for the same company for two years, an employee is entitled to a gratuity; however, if the employee is terminated, he will still be eligible to earn a gratuity for more than a year of service.

The gratuity in KSA is calculated as per the last basic salary of the employee and the type of separation either resignation or termination.

All-in-one platform, offering paperless processes, multiple automations, and AI-powered tools.