As Saudi Arabia remains to be a center for foreign investment and private sector development, companies looking to set up shop in the Kingdom got to have a great understanding of local compliance administrations. One of the foremost basic components of workforce compliance is the General Organization for Social Insurance (GOSI) in Saudi Arabia.

Whether expanding an existing presence or introducing a new one in Saudi Arabia, knowing and following to GOSI in Saudi Arabia controls is essential—not as it were to guarantee regulatory compliance but moreover to safeguard your labor force, realize business benefits, and ensure continuity of operations.

This blog gives employers a step-by-step examination of GOSI compliance, why it’s significant, contribution calculations, and how businesses can expect compliance pitfalls.

Why GOSI Compliance Is Important for Business Operations

GOSI compliance goes far beyond checking a regulatory box—it’s a fundamental pillar of Saudi Arabian labor law. Further, the GOSI in Saudi Arabia system guarantees that workers receive vital social insurance benefits like pensions, disability pay, unemployment benefits, and more.

Key Benefits and Reasons for Compliance:

- Legal Requirement: A valid GOSI certificate is mandatory for businesses to legally operate and participate in government projects.

- Eligibility for Contracts: Moreover, many public and private entities require GOSI in Saudi Arabia compliance to register vendors or approve tenders.

- Employee Assurance: Further, GOSI offers a security net for workers in case of unemployment, damage, disability, or retirement.

- Operational Progression: The need for compliance can lead to blocked transactions, postponed payments, and reputational risks.

- Financial Security: Anticipates fines and disturbance to cash flows—particularly basic for companies utilizing government contracts as a source of income.

Overall, staying compliant guarantees smooth running as well as reflects well on a firm’s adherence to equitable labor treatment.

How GOSI in Saudi Arabia Contributions Are Organized

Saudi employers are required to contribute a particular percentage of every employee’s salary to GOSI. Also, the requirements are different for Saudi citizens and expats and are divided between the employer and worker according to the insurance type.

GOSI Contribution Breakdown:

Insurance Type | Employee Contribution | Employer Contribution | Applicability |

Annuities (Pension) | 9% | 9% | Saudi Nationals Only |

Occupational Hazards Insurance | 0% | 2% | All Employees |

SANED (Unemployment Insurance) | 0.75% | 0.75% | Saudi Nationals Only |

Total Expatriate Contribution | 0% | 2% | Only Expat Employees |

Saudi Employee Contribution Total | 9.75% | 11.75% |

|

Important Note: Contributions from GOSI in Saudi Arabia are computed on the basis of the employee’s basic salary plus housing allowance, up to a maximum salary cap of SAR 45,000. Therefore, nothing above this is not included in the contribution calculation.

The Role and Significance of the GOSI Certificate

The GOSI certificate is a compliance document that is issued by the General Organization for Social Insurance. Further, it is official confirmation that a company is paying employee social insurance according to Saudi regulations.

- Bidding on Government Contracts: Without a GOSI in Saudi Arabia certificate, companies are not eligible to bid on government tenders.

- Vendor Registration: Needed to register as a supplier with both public and private organizations.

- License Renewals: Necessary for the renewal of business licenses and permits.

- Payment Clearance: Also, certain government-related payments might be delayed if the company doesn’t show a valid certificate.

Thus, the digital certificate is valid for 30 days. Companies need to renew for uninterrupted services.

What Happens if You Don't Comply with GOSI?

Disappointment in complying with GOSI in Saudi Arabia necessities can start various serious punishments that influence the financial and operational position of a company.

Risks of GOSI in Saudi Arabia Non-Compliance:

- Fines & Penalties: 2% interest is levied for every month of delayed payment on outstanding GOSI contributions.

- Delayed Transactions: Payments can be delayed or processes suspended until a valid GOSI in Saudi Arabia certificate is submitted.

- Tender Ineligibility: Firms are unable to bid for government contracts without proof of GOSI.

- Vendor Rejection: Most clients reject onboarding suppliers who do not demonstrate active GOSI compliance.

- Audit & Legal Risks: GOSI auditors can inspect, and incorrect records can lead to fines or sanctions.

In summary, ignoring GOSI in Saudi Arabia compliance can risk everything from cash flow to client relationships and legal status.

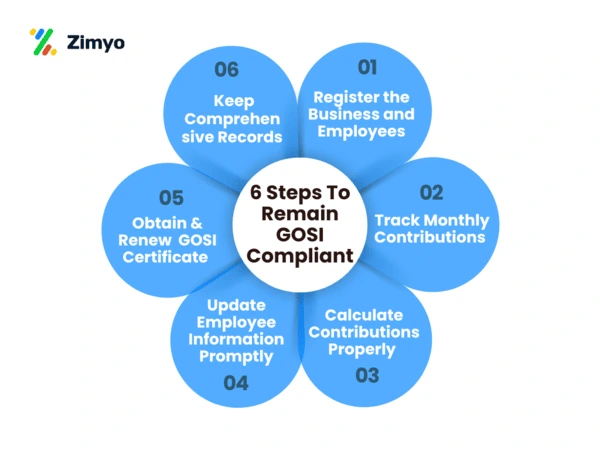

How to Stay GOSI Compliant: A Step-by-Step Guide

Moreover, GOSI in Saudi Arabia compliance might show up complicated, especially for international businesses, but employing a structured approach can essentially ease the method.

Step to stay GOSI compliant

1. Register the Business and Employees

- Company registration with GOSI via the online portal upon incorporation.

- Register all eligible employees—both Saudi nationals and expatriates—within 30 days of recruitment.

2. Track Monthly Contributions

- Overall, GOSI in Saudi Arabia contributions are due by the 15th of every month.

- Use reminders or payroll software to make payments on time and not incur penalties.

3. Calculate Contributions Properly

- Ensure salaries and housing allowances are accurately reported.

- Also, regularly review payroll data to ensure accurate deductions.

4. Update Employee Information Promptly

- Any changes to employee status (salary revisions, resignations, etc.) should be reflected immediately in the GOSI in Saudi Arabia system.

5. Obtain & Renew the GOSI Certificate

- Proactively request the certificate every 30 days before the previous one expires.

- Set automatic renewal workflows to avoid missing deadlines.

6. Keep Comprehensive Records

- Keep detailed compliance and payroll records for audit purposes.

- Incomplete or incorrect data can lead to fines or rejection during inspection.

The Value of Expert Support

Having a professional advisory firm on board can greatly minimize the risk of non-compliance. For instance, companies assist international businesses with:

- GOSI registration and document management

- Payroll calculation and contribution tracking

- Certificate renewals

- Real-time compliance support

Their knowledge of local laws ensures you avoid pitfalls and stay focused on growth.

Digital Compliance Tools: Simplifying the Process

Technology can also help streamline GOSI in Saudi Arabia management. Also, platforms like zimyo offer HR and payroll automation tailored for Saudi compliance needs.

Key Benefits

- Automated GOSI Deduction: Calculates exact contributions for each employee.

- Real-Time Compliance Dashboard: Track pending payments and renewals.

- Employee Self-Service (ESS): Employees can access their GOSI records at any time with ESS.

- Audit-Ready Reports: Create GOSI reports, pay slips, and documentation for submission.

- Error-Free Payroll Processing: Automated payroll software minimize manual errors.

Overall, through the utilize of devices businesses can minimize regulatory overhead while guaranteeing full compliance with local laws.

Conclusion

Overall, with Saudi Arabia fixing its administrative environment and advancing toward Vision 2030 objectives, GOSI in Saudi Arabia compliance is still a cornerstone for organizations doing business inside the Kingdom. Whether it is a matter of maintaining legal progression, protecting employees’ rights, or being eligible for government tenders, GOSI in Saudi Arabia compliance is not an option.

Moreover, employers who get ahead of GOSI obligations—via prepared specialists or innovative HR technology—develop a competitive edge whereas steering clear of penalties and operational disruptions.

Further, for managers, this translates to more than simple registration—it’s approximately keeping records up to date, preparing opportune contributions, and recharging the GOSI certificate on a monthly basis. Also, non-compliance can result in overwhelming money related fines, delayed transactions, and loss of business opportunities.

Thus, to automate this imperative component of HR and payroll administration, companies can depend on advanced computerized solutions such as Zimyo.

In short, by joining Zimyo into your HR operations, you not only guarantee full GOSI compliance but also diminish administrative burdens and upgrade the overall employee involvement.

Whether starting a new business in Saudi Arabia or growing operations, keeping one step ahead of GOSI compliance, schedule a demo to ensure a smoother, smarter route to success.

Frequently Asked Questions (FAQs)

GOSI compliance goes far beyond checking a administrative box—it’s a essential column of Saudi Arabian labor law. The GOSI framework ensures that workers get imperative social protections benefits like benefits, disability pay, unemployment benefits, and more.

In Saudi Arabia, employers are required to contribute 2% of an expatriate employee’s compensation to GOSI. Expatriate workers themselves are not committed to creating any GOSI contributions.

To stay compliant with GOSI, employers must:

- Register their business and employees within 30 days of hiring

- Submit monthly contributions by the 15th,

- Accurately calculate based on salary plus housing allowance,

- Promptly update any employee changes in the system,

- Renew the GOSI certificate every 30 days, and

- Maintain complete payroll and compliance records for audits.

For Saudi employees, the overall GOSI commitment is 21.5% of the essential salary additionally housing allowance—split as 11.75% from the manager and 9.75% from the employee. This covers retirement, unemployment, and occupational risk insurance. For expatriates, only employers contribute 2%, while expat employees are exempt from any GOSI payments.

The GOSI certificate is important for bidding on government contracts, vendor registration, license renewals and payment clearance. The digital certificate is valid for 30 days. Companies are required to renew it in advance to prevent interruption in services.