Calculate your Take Home salary in a click! Know the detailed salary breakup of your CTC

| Annual CTC | ||

| Component | Monthly | Annual |

| Basic Salary | 0 | 0 |

| HRA | 0 | 0 |

| Special Allowances | 0 | 0 |

| Gross Salary | 0 | 0 |

| Employee Contribution | ||

| EPF | 0 | 0 |

| Labour Welfare Fund (LWF) *Varies State Wise | 0 | 0 |

| ESIC | 0 | 0 |

| Employer Contribution | ||

| EPF | 0 | 0 |

| Labour Welfare Fund (LWF) | 0 | 0 |

| ESIC | 0 | 0 |

| Take Home Salary | 0 | 0 |

Have you ever wondered how much of your CTC actually lands in your bank account? If you’ve ever tried to figure out your in hand salary, you know it can be a confusing task. You may see a large CTC on your offer letter, but your take home amount is often much lower. That’s where an in hand salary calculator comes in handy!

This tool helps you estimate take home pay from salary by accounting for various deductions and taxes.

CTC, or Cost to Company, refers to the total amount a company spends on an employee. It includes the employee’s basic salary, bonuses, allowances, and all the benefits provided by the employer. However, CTC does not represent the in hand salary or the actual amount employees receive after all the deductions. To know your take home salary, you need to consider several deductions and statutory compliances.

You might be wondering, why should I bother using an salary calculator from take home? Here are some good reasons why it’s essential for both employees and employers:

An in hand salary calculator provides transparency by showing how your CTC is distributed. It breaks down your salary into various components. Then shows how much you can actually take home after taxes and contributions.

Knowing your take home salary is crucial for managing your personal finances. You can plan your budget, savings, and expenses more effectively when you know the exact amount you’ll receive. Thus, helping in sound financial planning.

If you are negotiating a job offer, understanding your in hand salary is key. With the help of an in hand pay calculator, you can compare offers, factoring in taxes and deductions.

For employers, an in hand salary calculator ensures accurate tax calculations and statutory deductions. Such as Provident Fund (PF) and Professional Tax (PT). This helps in staying compliant with government regulations.

When employees clearly understand their in hand salary, it leads to greater job satisfaction. They are more engaged and feel valued by their employer.

For employers, an in hand salary calculator helps estimate the actual cost of hiring an employee. This includes taxes and contributions, beyond just the CTC.

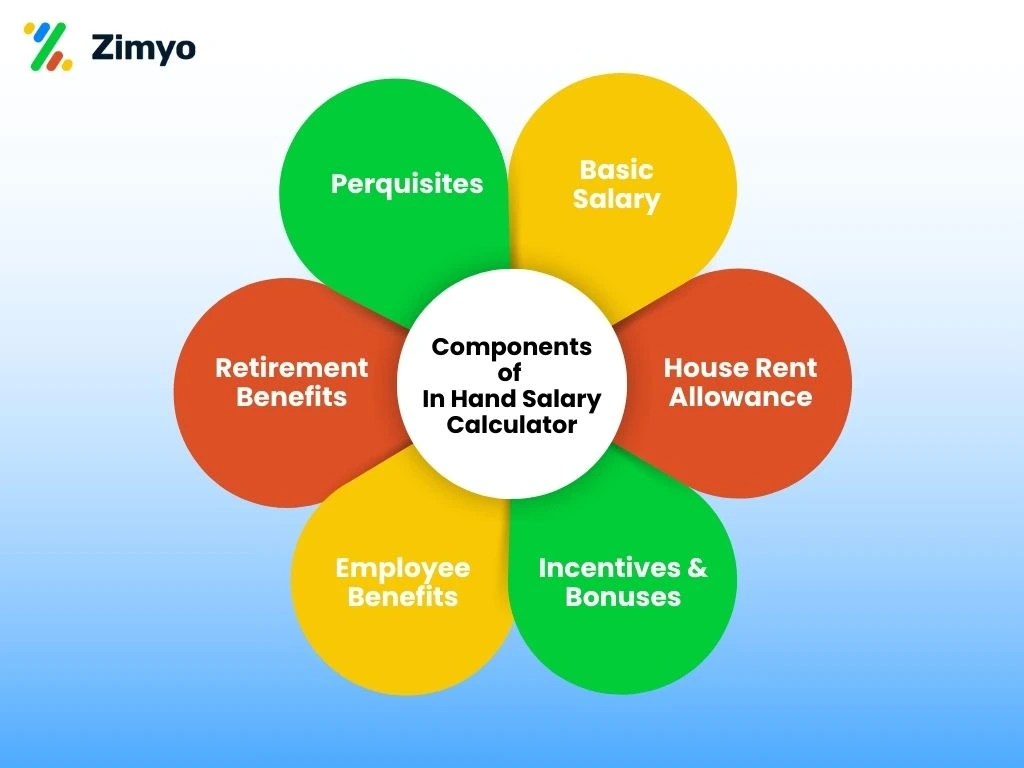

Let’s break down the components used in an in hand salary calculator to help you understand the figures:

Your basic salary is the fundamental pay you receive for your work. It typically accounts for 50% of your CTC. For example, if your CTC is ₹5,00,000, your basic salary might be ₹2,50,000 annually.

HRA or House Rent Allowance is an allowance given to employees to help with living expenses. It’s usually calculated as 40% or 50% of your basic salary, depending on your company’s policies.

Some companies provide incentives and bonuses based on performance. These payments can be added to your salary, though they might not be guaranteed every month.

Employee benefits may include health insurance, life insurance, or other perks offered by the company. These are deducted from your CTC and contribute to your overall compensation.

Provident Fund (PF) contributions are part of your retirement benefits. Employees contribute 12% of their basic salary to the PF, which is matched by the employer.

Perquisites are additional benefits provided by the company, such as company cars, phone bills, or housing.

Now, let’s talk about the deductions that impact your take home salary:

Your income tax is deducted according to the applicable tax slabs. This varies depending on your annual income.

The EPF is deducted from the employee’s salary and contributes to the employee’s retirement savings. Typically, the contribution is 12% of the basic salary, but it’s capped at ₹1,800 if your basic salary is more than ₹15,000.

Professional Tax is levied by certain states. The amount differs from state to state and is deducted monthly.

Some other deductions include ESI (Employee State Insurance), LWF (Labour Welfare Fund), and more. These deductions vary depending on your salary, company policies, and location.

To calculate your take home salary, use the following formula:

Take home salary = Gross Salary – [12% PF contribution (Employee) + LWF (Employee) + ESIC (If Applicable)]

Let’s say an employee has an annual CTC of ₹6,00,000. Here’s how the salary would break down:

Gross Salary = Basic Salary + HRA + Bonuses = ₹3,00,000 + ₹1,20,000 = ₹4,20,000

Now, subtract the deductions:

Take home Salary = Gross Salary – (PF + Other Deductions) = ₹4,20,000 – ₹48,000 = ₹3,72,000 annually, or ₹31,000 monthly.

You can use our take home salary calculator at the top of this page to get your salary breakdown in just seconds! By entering your CTC and other relevant details, you can easily calculate your in hand salary after tax and deductions.

An in hand salary calculator is an essential tool for both employees and employers. It helps to understand salary breakdowns and estimate take home pay. And also, to ensure compliance with tax laws.

By using a salary and take home pay calculator, you can make informed decisions. Such as the decisions about your finances, salary negotiations, and budgeting. So, next time you wonder about your in hand salary, simply use a CTC to in hand salary calculator to get a clearer picture of your take home amount!

Now that you know how an in hand salary calculator works, have you tried calculating your salary yet?

I was able to implement the platform on my own. It helps in assigning the tasks to other employees, conducting surveys and polls, and much more. The ease of use and self-onboarding is something that I would like to appreciate.

Sonali, Kommunicate

Zimyo simplifies attendance management for our organization. The leave and attendance are so streamlined that we have never faced any difficulties with the system.

Anurag, Eggoz Nutrition

In hand/ take Home salary= Gross Salary- Income Tax- Professional Tax

CTC(Cost to company) refers to the total amount that a company has to spend on an employee. CTC and in hand salary are two different things.

The major components of an employee’s salary are Basic salary, HRA, LTA, bonus, perks etc.

“I was able to implement the platform on my own. It helps in assigning the tasks to other employees, conducting surveys & polls & much more. The ease of use & self-onboarding is something that I would like to appreciate.”