What is EPFO?

The EPFO full form stands for Employees’ Provident Fund Organization. The EPFO or the Employee’s Provident Fund Organization is defined to be a statutory body that falls under the Government of India’s Ministry of Labor and Employment. The main duty that the EPF is responsible for is the regulation and management of the provisional funds of India.

The mandatory provident fund is administered by the EPFO administrators. The EPFO is the Employee’s Provident Fund Organization and is actually one of the largest social security organizations in the entire world. It is described to be a financial body that is responsible for providing social security to the employees who are rendered salaried in India. The main retirement benefits scheme which falls under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 and is managed by EPFO is the EPF.

The Employee’s Provident Fund Organization was established when Employees’ Provident Funds Ordinance was declared on the date of 15th the month November in the year 1951. The following year, the Employees’ Provident Funds Ordinance got replaced by the Employees’ Provident Funds Act, which was in the succeeding year, 1952. The government currently refers to this act from 1952 as the Employees’ Provident Funds & Miscellaneous Provisions Act, 1952.

Was on October 1, in the year 2014, when a new program was launched by the Government of India known as a Universal Account Number for employees, which was in cover by Employees’ Provident Fund Organization. The main reason behind the launching of such a new program was the intention of enabling the portability of the Provident Fund Number.

How to login to EPFO?

You can log into the EPFO portal by:

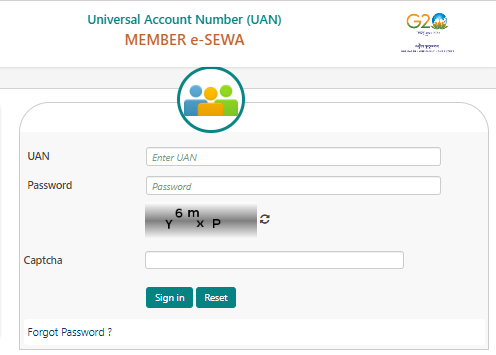

1. Visit the EPFO Member Portal.

2. Enter your UAN number, password, and captcha.

3. Click on “Sign In.”

After logging in, you can access your EPF account, check balance, claim status, and update personal information like bank details or KYC.

How to claim EPFO?

Claiming your Employee Provident funds can be done through the EPFO portal as follows:

1. Log in to the EPFO member portal using your UAN and password.

2. Navigate to the “Online Services” tab and click on “Claim (Form-31, 19 & 10C)”.

3. Verify your KYC details, such as your Aadhaar, bank account, and PAN.

4. Select the type of claim you want (full EPF settlement, part withdrawal, or pension withdrawal).

5. Submit the claim form after entering the required details. Your claim status can be tracked on the Employees’ Provident Fund Organization portal.

How to change EPFO password?

Changing your EPFO password is a simple process:

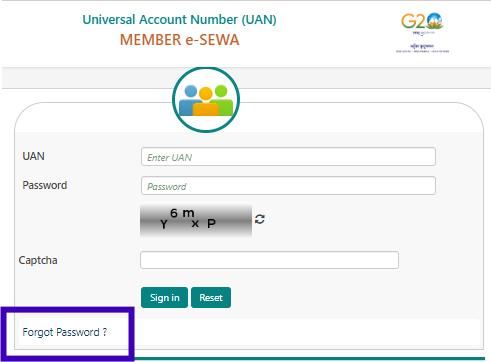

1. Go to the EPFO member login page.

2. Click on the “Forgot Password” link.

3. Enter your UAN number and verify with OTP sent to your registered mobile number.

4. Once verified, you will be prompted to create a new password for your Employees’ Provident Fund Organization account.

How to withdraw money from EPFO?

To withdraw money from your EPFO account, you can follow these steps:

1. Log in to the EPFO portal using your UAN number and password.

2. Under “Online Services,” click “Claim (Form-31, 19 & 10C).”

3. Enter the last four digits of your bank account linked with EPFO.

4. Select the type of withdrawal (final settlement, partial withdrawal, or pension withdrawal).

5. Complete the application and submit it. The withdrawal amount will be credited to your bank account linked with your Employees’ Provident Fund Organization account.

How to update bank details in EPFO?

To update your bank details on the EPFO portal:

1. Log in to the EPFO portal using your UAN.

2. Go to the “Manage” section and select “KYC.”

3. Under the KYC update section, click “Bank.”

4. Enter your new bank account number and IFSC code, then submit.

5. Once the employer approves the new details, they will be updated in your Employees’ Provident Fund Organization account.

How to change mobile number in EPFO?

To change your mobile number on the EPFO portal:

1. Log in to the EPFO portal using your UAN and password.

2. Click on the “Manage” tab and select “Contact Details.”

3. Update your mobile number and submit.

4. Verify with the OTP sent to the new number, and the changes will reflect in your Employees’ Provident Fund Organization account.

How to update KYC in EPFO?

Updating KYC on the EPFO portal is essential for withdrawals and claims:

1. Log in to the EPFO portal with your UAN.

2. Go to “Manage” and select “KYC.”

3. Upload your updated Aadhaar, PAN, and bank details.

4. Once verified by the employer and Employees’ Provident Fund Organization, your KYC details will be updated.

How to link Aadhar with EPFO?

Linking your Aadhaar with your EPFO account ensures seamless claim processing:

1. Log in to the EPFO portal using your UAN.

2. Go to the “Manage” tab and select “KYC.”

3. Under the KYC section, click on “Aadhaar.”

4. Enter your Aadhaar number and submit.

5. Once verified by the Employees’ Provident Fund Organization, your Aadhaar will be linked to your account.

How to Activate UAN Number on EPFO Portal?

To activate your UAN number on the EPFO portal:

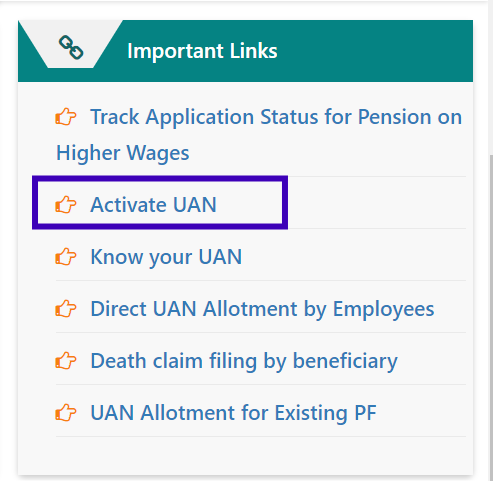

1. Visit the EPFO Member Portal.

2. Click on “Activate UAN.”

3. Enter your UAN number, member ID, Aadhaar, and mobile number.

4. Once you submit the details, you’ll receive an OTP to your registered mobile number.

5. Enter the OTP to complete the UAN activation process. After activation, your UAN number will be linked to your Employees’ Provident Fund Organization account.

What is PPO number in EPFO?

The PPO (Pension Payment Order) Number in the EPFO is a unique 12-digit number assigned to retirees who are eligible for pension benefits.

This number helps pensioners track their pension disbursements. EPFO issues the PPO number once the employee retires and their pension is processed. Know your PPO Number.

What are NCP days in EPFO?

NCP (Non-Contributory Period) Days in the EPFO represent the days during which the employer has not made any contributions to the employee’s EPF account.

NCP days typically occur when an employee is on leave without pay or absent from work. These days are reflected in the employee’s EPFO record and impact the overall EPF contribution.

EPFO’s Role in Employee Welfare

The Employees’ Provident Fund Organization plays a critical role in safeguarding employees’ financial future through retirement savings, pension benefits, and insurance coverage.

By utilizing the EPFO services—such as checking balances, updating KYC, and withdrawing funds—employees can manage their EPF accounts effortlessly.

EPFO has now launched the Employees’ Enrolment Scheme – 2025 to enroll workers left out between 1 July 2017 and 31 October 2025. The six months window will open from 1 Nov 2025 to 30 Apr 2026 offers relief from employee share contributions and the employer has to pay only their own share of contribution, interest, administrative charges, and a penalty of ₹ 100. The establishments that are already under inquiries proposed like 7A, Para 26B, or Para 8 also would come under this scheme. The scheme is intended to increase EPF coverage and contribute to the Government’s vision of ensuring “Social Security for All."

FAQs (Frequently Asked Questions)

The Employees’ Provident Fund Organisation (EPFO) is a statutory body under the Ministry of Labour and Employment, Government of India.

It administers and oversees the Employees’ Provident Fund (EPF), Pension Scheme (EPS), and Insurance Scheme (EDLI) for the workforce.

The Employees’ Provident Fund Organisation (EPFO) is crucial for ensuring financial security for employees in India.

It manages the Employees’ Provident Fund (EPF), where both employees and employers contribute towards retirement savings. The EPFO also administers pension schemes and insurance benefits, providing a safety net for employees and their families.

To check your EPF balance, log in to the EPFO Member Portal using your UAN and password.

You can also check through the UMANG app, by sending an SMS “EPFOHO UAN ENG” to 7738299899, or by giving a missed call to 011-22901406 from your registered mobile number.

The PPO (Pension Payment Order) Number in EPFO is a unique 12-digit number issued to retirees eligible for pension benefits.

It helps track pension disbursements and ensures smooth processing of pension payments. The PPO number remains essential for retirees to manage their pension-related services and inquiries.

The EPF Member Passbook is an online document available on the EPFO portal that provides a detailed record of an employee’s EPF account.

It shows monthly contributions from both employer and employee, along with interest earned. The passbook helps employees track their EPF balance and transactions easily.