Introduction

Have you ever wondered how employees in India get medical and financial support in case of illness, maternity, or accidents? The Employee State Insurance Corporation (ESIC) is a government run social security system.

But how does it work? What are the benefits? And how do you access them? Let’s know all the details.

What is ESIC Meaning & Definition?

ESIC means Employee State Insurance Corporation. It is a government organization that provides healthcare and financial employee benefits to employees working in companies. If a worker earns ₹21,000 or less per month (₹25,000 for disabled employees), they are covered under this scheme.

Both the employer and employee contribute a small amount to ESI every month. In return, it helps employees with free medical treatment, maternity benefits, disability support, and compensation for job related injuries or illnesses. It ensures that workers and their families get financial and medical security in times of need.

Features of Employee State Insurance Corporation:

- Medical Benefits: Free medical treatment for employees and their dependents at ESI hospitals and dispensaries.

- Maternity Benefits: Financial support during pregnancy and post-delivery care.

- Disability Benefits: Compensation for temporary or permanent disability due to workplace accidents.

- Sickness Benefits: Cash allowance during certified medical leave.

- Dependent Benefits: Financial aid to family members in case of an employee’s death due to employment-related injury.

- Funeral Expenses: Fixed amount of ₹15,000 for funeral costs.

What is an ESI Number?

Every insured employee gets a unique 10-digit number, which serves as their identity in the system. This number is needed to get medical care, financial benefits, claim settlements and many more such employee benefits.

How to Find Your ESI Number?

- Payslip: Employers often include the ESI number on the salary slip.

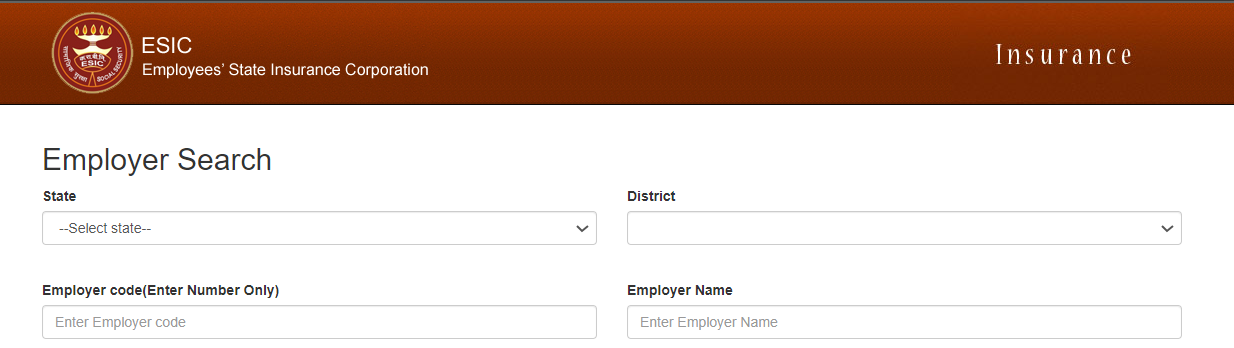

- Portal: Log in to www.esic.nic.in and check your details.

- HR Department: Your employer can provide you with the number.

How to Calculate ESI Contribution?

The contribution is deducted from the employee’s salary and also paid by the employer.

Contribution Rates:

- Employee Contribution: 0.75% of gross salary.

- Employer Contribution: 3.25% of gross salary.

- Total Contribution: 4% of the employee’s gross salary.

Now you can easily calculate your ESI contribution with our easy to use ESI Calculator.

How to Check ESI Balance?

To check your balance, follow these steps:

- Visit the portal (www.esic.nic.in).

- Log in with your credentials.

- Go to the Employee Section.

- Check your contribution details and balance.

Alternatively, you can visit the nearest branch to get your balance details.

What is an ESI Card (Pehchan Card)?

The ESI Card (Pehchan Card) is an identification card issued to beneficiaries. It enables employees and their families to avail themselves of medical benefits at ESI hospitals.

How to Apply for an ESIC Card?

- Employer registers you under ESI.

- Log in to the portal and download the Pehchan Card.

- Print the card or collect a physical copy from your employer.

How to Download ESIC Card?

- Log in to the ESIC website (esicportal).

- Go to Employee Section > Print ESIC Card.

- Download and print the card.

What is an IP Number?

An IP (Insured Person) number is another term for an ESI number. It is used to track employee contributions and benefits in the employee state insurance corporation system.

ESIC Act, 1948: Understanding Its Importance

The Employees State Insurance Act, 1948, ensures financial protection for employees in case of:

- Sickness

- Maternity

- Disablement

- Employment-related injuries

- Death of an employee

Employers must register under ESI if they have 10 or more employees (20 in some states).

How to Download ESIC Payment Receipt?

To download your Employee State Insurance Corporation ESIC payment receipt:

- Log in to the esicportal.

- Go to Payment History.

- Select the desired period.

- Download the ESI receipt (PDF).

How to Download ESI Challan?

Employers need to generate ESI challans to complete their monthly ESIC payments.

Steps to Download ESI Challan:

- Log in to www.esic.nic.in

- Go to the Payment Section > Challan Generation.

- Select the required period.

- Download the challan (PDF).

How to Add Family Members in ESI?

You can add your family members to your ESI account for extended coverage.

Steps to Add Family in ESI:

- Log in to the ESI gateway.

- Go to Update Family Details.

- Enter details (Name, Aadhaar, Age, Relation).

- Save the updates.

Your dependents will now be eligible for ESI benefits.

I was able to implement the platform on my own. It helps in assigning the tasks to other employees, conducting surveys and polls, and much more. The ease of use and self-onboarding is something that I would like to appreciate.

Sonali, Kommunicate

Zimyo simplifies attendance management for our organization. The leave and attendance are so streamlined that we have never faced any difficulties with the system.

Anurag, Eggoz Nutrition

Conclusion

The Employee State Insurance Corporation (ESIC) is a crucial safety net for employees, offering financial and medical protection. Whether you need to check your ESIC number, download an ESIC card, generate an ESIC challan, or check your ESIC payment status, the esicportal make everything accessible online.

By understanding ESIC, employees can make the most of their healthcare benefits, maternity support, and financial aid during medical emergencies. Stay informed, use your ESIC benefits, and secure your future!

FAQs (Frequently Asked Questions)

The Employees’ State Insurance Corporation (ESIC) is a social security organization under the Ministry of Labour and Employment, Government of India.

ESIC provides health insurance and various other benefits such as medical, disability, maternity, and dependent benefits to employees earning less than ₹21,000 per month.

Employees earning wages up to Rs. 21,000 per month are eligible for ESI coverage.

Yes, ESI is applicable pan-India, with variations in certain regulations across states.

Documents such as PAN card, address proof, employee details, and establishment documents are required for ESI registration.