Retention Bonus Meaning

A retention bonus is a payout given to employees in addition to their regular payout to ensure they stay longer with the organization. A negotiable bonus helps to remain competitive within the industry and reduce churn rate.

Official Retention Bonus Definition

A retention bonus is a financial incentive paid by an employer to an employee to encourage them to remain with the organization for a specified period, typically during critical business phases such as mergers, restructuring, leadership transitions, or high-priority projects.

It is usually offered as a one-time lump-sum payment, contingent upon the employee staying through the agreed duration or milestone. These bonuses are used to reduce turnover risk, maintain continuity, and secure key talent whose departure could negatively impact operations.

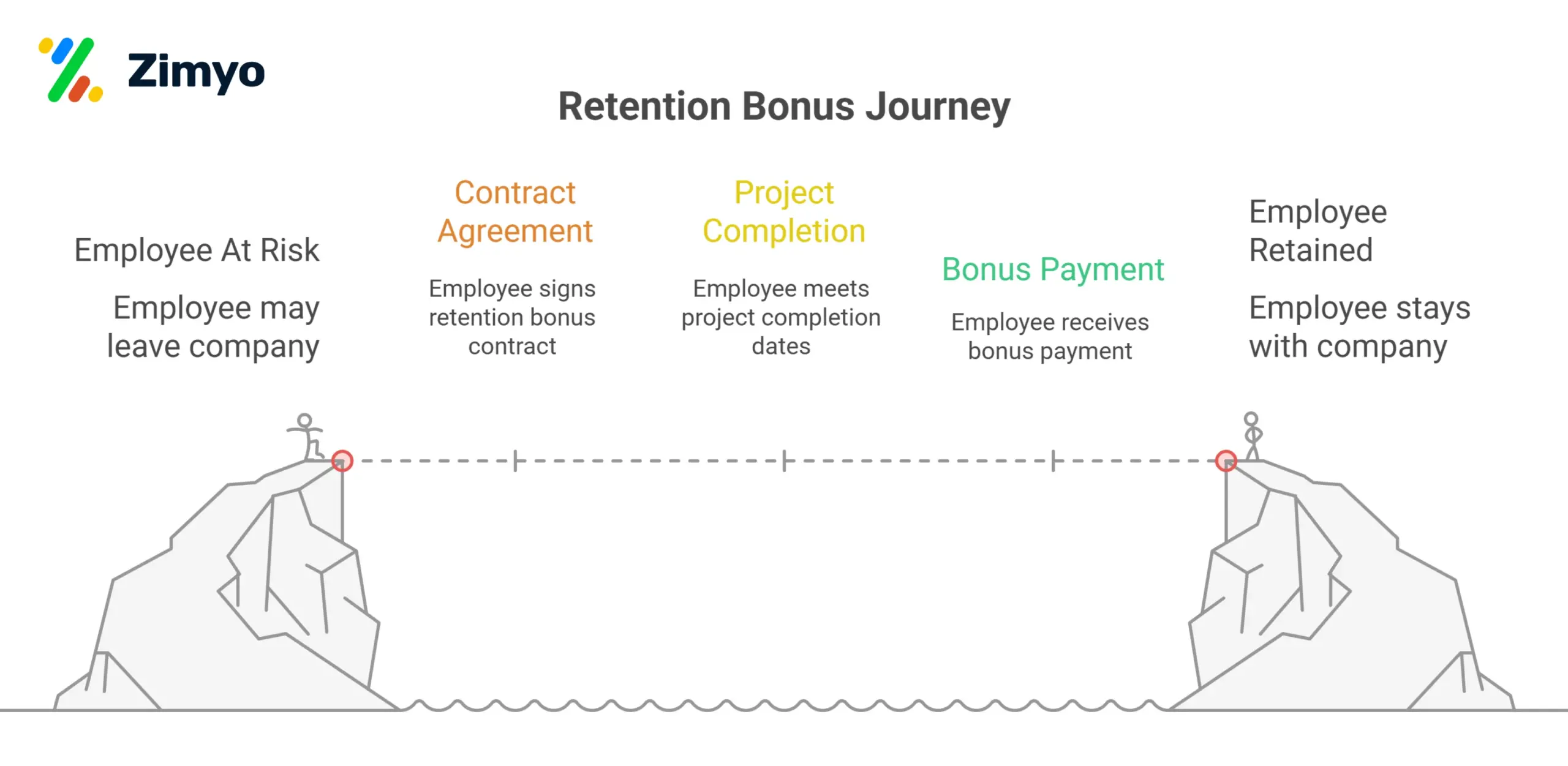

How does Retention Bonus Work?

Key points to remember:

Retention bonuses require a contract stating how long the employee must stay.

Terms may link to specific project completion dates.

Paid either as a lump sum or monthly installments to ensure continued stay.

Employees can negotiate or refuse the bonus.

The bonus is fully taxable and usually counted under salary.

Now, let us understand in detail how does this work.

Organizations generally take various measures to ensure that employees do not immediately leave the organization after taking the bonus. Most organizations make contracts or written agreements to ensure the employees stay. It is an agreement states how long the employee has to remain in the organization after signing a retention agreement or contract.

For example, If an employee is working on a certain project and the employer wants the employee to stay with them until the project is completed he can mention the date of project completion in the contract. While the company can pay the retention bonus in a lump sum amount they can also pay the retention bonus along subsequent months. Using the monthly payout of retention bonus the employer can ensure that employees will stay till the end of the payment.

There is always a door for negotiation. An employee can always negotiate their retention bonus if they are not satisfied with it. They are free to reject if the bonus is not fair according to them. This pay is fully taxable under the taxable income. The organization can put the pay under the salary head to charge bonus under a highly taxable bracket.

Circumstances in which Retention Pay is Provided

A retention pay is provided under certain circumstances. Some of these circumstances are:

- In order to ensure the best talent retains in the organization, a retention bonus is provided to employees.

- It is provided when a company is experiencing a merger, acquisition or organizational restructuring.

- When management suspects that an employee is going to leave the organization, a retention pay is provided to motivate them to stay with the organization.

Factors to Consider while Providing Retention Pay

Retention pay typically varies from organization to organization in the range of 10-15% of an employee’s basic salary. It can be provided in a lump sum, weekly or monthly.

1. The state of the job market

In a competitive job market it’s necessary for organizations to hold employees for a long period of time. In order to motivate employees to stay long with them, organizations provide bonuses. It is not directly dependent on the performance of the employee but still it’s a great way to hold the employees.

2. Time with the company

Employee’s current level and their tenure with the organization is a major factor that directly affects their retention pay. The amount of the pay is related to their tenure.

3. The impact of losing an employee

Hiring fresh talent proves to be costly for the organization. So a company opts to pay retention to existing employees to motivate them to stay long with the organization.

4. The company’s business performance and financial stability

The performance of an organization and financial stability in the industry is a key factor that decides whether they will pay or not. It proves to be a better alternative to losing a dedicated employee.

5. Current projects

When an employee is planning to leave the organization in the middle of a project, providing him with a pay is a better choice rather than letting him leave.

Retention Pay Agreement

Every retention pay follows a certain set of criteria or agreement. Some of the common criteria are:

- Financial Terms: This includes the mode in which retention pays are provided to employees. It can be paid in lump-sum amount, quarterly or in the form of ESOPS( Employee stock option plan).

- Employment Status: This means an employee must be retained or employed in the organization on a specific day or period. This period of time is called vesting period.

- Financial Health: The financial condition include the financial position of the organization or the firm should be solvent

- Continued Employment Disclaimer: It means there is no guarantee of continued employment after the vesting period ends.

- Non-disclosure agreement: It ensures that employees must not disclose any information to external parties or competitors during the course of the retention period.

- Bonus Assignment: It confirms that if the company will be merged or acquired during the retention period the bonus will be assigned to the new entity.

- Signature: The retention pay must include the signature of the authorized person to ensure its authenticity.

Retention Bonus Policy

Objective

The purpose of this policy is to retain certain valuable employees for a long time in the organization. The ……..…(company name) has announced a retention policy to motivate employees to stay long with ……..…(company name).

Eligibility

Employees who are eligible for retention bonuses are selected by management and HRs on an unbiased basis in continued business operations.

Other casual employees are ineligible this time for this bonus.

Each employee eligible for a retention pay will receive ……..… Amount in this quarter along with their monthly salary.

No amount will be paid to employees who will terminate their employment with the organization before the distribution of the retention pay.

Tax Considerations

Retention bonuses are fully taxable in the year in which it is provided. In addition, the company will bear the whole amount of tax on retention bonuses so that employees will receive a full amount of retention pay.

Alternatives of Employee Retention

In order to retain employees in the organization, a retention bonus is not only the solution. There are various alternatives to this pay:

1. Performance Bonuses: The company can provide performance bonuses to their employees when they meet certain targets or goals.

2. Merit increases: A merit increase is a strictly performance based financial incentive that boosts employee performance and retention rate. Merit pay depends on certain factors such as seniority, number of years with organization and promotion.

3. Employee Promotion: When an employee is promoted it moves the employee to a higher position and results in their salary increase which motivates them to stay long with the organization.