When you start working in a company, you often hear terms like PF, UAN, or Provident Fund. But before understanding those, let’s first see what exactly is PF, and why is it important?

Provident Fund, is a long term savings scheme started by the government of India to help employees save money for their future. Hence every month, you save a small part of your salary in your PF account, and your employer also contributes an equal amount. Over time, this collected fund earns interest and becomes a large savings amount over time.

Furthermore, you can check your PF balance, track your PF claim status, or even make a PF withdrawal using the PF portal. The idea behind this scheme is simple, to help you build financial security for your retirement and emergency needs.

What is Provident Fund (PF)?

Provident Fund is a retirement savings scheme managed by the Employees’ Provident Fund Organisation (EPFO). Both employees and employers contribute to this fund every month.

Here’s how it works:

The company deducts 12% of your basic salary and deposits it in your PF account.

Your employer also contributes 12% of your salary to your PF and pension fund.

EPFO safely manages the money and it earns annual interest.

Later, when you retire or leave your job, you can withdraw this money. Additionally, you can also partially withdraw your PF balance for specific reasons like buying a home, paying for higher education, or medical emergencies.

Finally, you can check your PF balance, status, or even initiate a PF withdrawal using the PF member login on the portal.

What are Provident Fund Benefits?

The Provident Fund is not just a savings plan. It provides many financial benefits that help you during and after your working years.

1. Financial Security After Retirement

Your provident fund savings act as a safety net after retirement. Since you and your employer contribute every month, this fund grows continuously. Making sure that you have enough money when you stop working.

2. Tax Benefits

Provident contributions qualify for tax deductions under Section 80C of the Income Tax Act. You can save up to ₹1.5 lakh every year in taxes. Also, the interest earned and the amount you withdraw after retirement are tax-free if certain conditions are met.

3. Pension Benefits

A part of your employer’s provident fund contribution goes into the Employee Pension Scheme (EPS). This ensures that you receive a monthly pension after retirement.

4. Insurance Coverage

It also provides Employee Deposit Linked Insurance (EDLI) benefits. In case of the employee’s death, their family receives a lump-sum insurance amount.

5. Easy Withdrawals During Emergencies

If you face a medical emergency, want to pay for your education, or purchase a home, you can withdraw money from your PF balance. These are called partial withdrawals and can be made online.

6. Guaranteed Returns

Provident fund is managed by the government, so your money is completely safe. You earn a fixed rate of interest every year, which makes it one of the most reliable investment options.

Types of Provident Fund

There are three major types of Provident Fund in India. Each type is designed for different categories of people.

1. Employees’ Provident Fund (EPF)

This is for employees working in private and government organizations.

Both the employee and employer contribute 12% of the employee’s basic salary every month.

The fund earns interest, which is added to your PF balance every year.

Employees can access their PF login through the EPFO portal to check their balance and contributions.

2. Public Provident Fund (PPF)

This is for individuals who want to save voluntarily, including self-employed people and business owners.

You can open a PPF account in a bank or post office.

The minimum deposit is ₹500 per year, and the maximum is ₹1.5 lakh per year.

The interest rate is announced by the government every quarter.

PPF has a lock-in period of 15 years but can be extended further.

3. General Provident Fund (GPF)

It is available for government employees.

Only the employee contributes to the fund, not the employer.

The contribution rate is fixed based on the employee’s salary.

Employees can withdraw their GPF balance after retirement or under certain conditions.

Who is Eligible for Provident Fund?

PF eligibility depends on the size of the organization and the salary of the employee.

Organizations with 20 or more employees must register for PF under the EPFO Act.

Employers must register employees earning up to ₹15,000 per month for PF.

Employees earning more than ₹15,000 per month can also join voluntarily.

Both permanent and contract employees qualify if EPFO has registered their company.

Employers and employees can access their accounts through PF employer login and PF member login on the official PF portal.

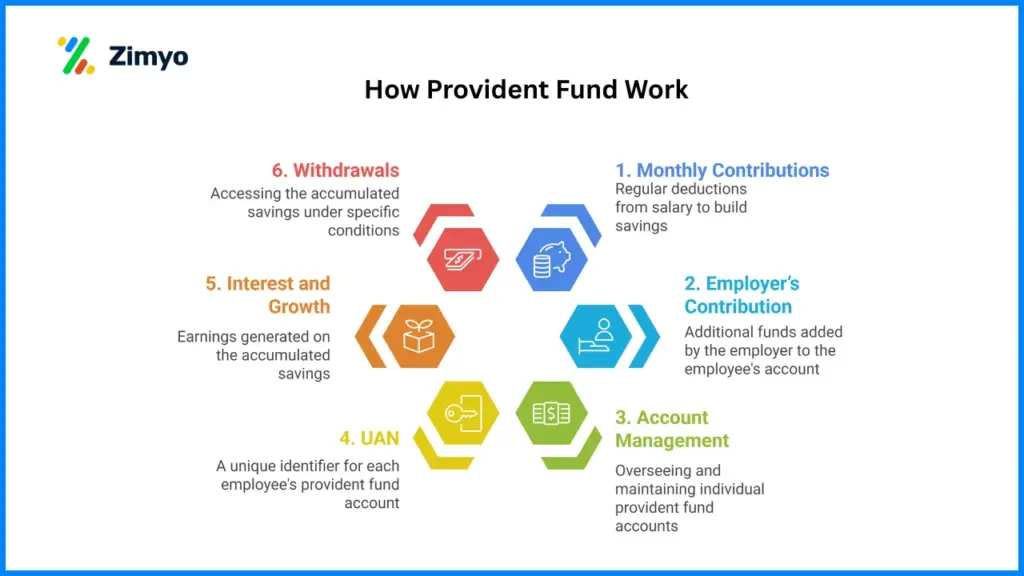

How Does Provident Fund Work?

Here’s a step-by-step explanation of how it works:

1. Monthly Contributions:

Every month, a fixed percentage (12%) of your basic salary is deducted and added to your PF account. The employer also contributes an equal amount.

2. Division of Employer’s Contribution:

Out of the employer’s 12%, 8.33% goes to the Employee Pension Scheme (EPS) and 3.67% goes to your PF account.

3. Account Management:

The Employees’ Provident Fund Organisation (EPFO) manages your PF money. They credit annual interest to your account.

4. UAN (Universal Account Number):

Each employee gets a unique number called UAN, which remains the same even if you change jobs. You can use this UAN to log in to your PF portal and check your PF balance, PF claim status, or PF withdrawal request.

5. Interest and Growth:

The PF balance earns interest every year, and the total amount keeps increasing as long as you are working.

6. Withdrawals:

You can withdraw the full PF amount after retirement or partial amounts for specific needs.

This simple system ensures steady savings and financial growth for employees throughout their careers.

How to Check PF Balance?

You can check your PF balance in several easy ways.

1. Using the PF Portal (Online Method)

- Visit the official EPFO website – https://www.epfindia.gov.in

- Go to the ‘Member e-Sewa Portal’ section.

- Click on PF member login.

- Enter your UAN, password, and the captcha code.

- After logging in, you can see your PF balance, PF status, and other details.

2. Using the UMANG App

- Download the UMANG app from Google Play Store or Apple App Store.

- Log in with your mobile number registered with EPFO.

- Choose the “EPFO” service.

- Select “Employee Centric Services” and tap on “View Passbook.”

- Your PF balance and details will appear on the screen.

3. Through SMS

You can also check your PF balance through SMS.

Send the message “EPFOHO UAN ENG” to 7738299899 from your registered mobile number.

You will receive an SMS with your PF balance details.

4. Through Missed Call

Give a missed call to 9966044425 from your registered mobile number.

You will receive an SMS showing your PF balance check details.

How to Withdraw PF Amount?

You can withdraw your PF amount both online and offline.

1. PF Withdrawal Online

Follow these steps to make an online PF withdrawal:

Visit the EPFO Member Portal and log in using your UAN and password.

Click on “Online Services” and choose Claim (Form-31, 19, 10C).

Verify your bank account details.

Select the type of withdrawal – full or partial.

Enter the reason for withdrawal such as home purchase, medical expenses, or retirement.

Submit the claim form.

Once your application is approved, the PF amount will be credited to your bank account. You can check your PF claim status online on the same portal.

2. PF Withdrawal Offline

You can also withdraw PF offline by submitting a physical withdrawal form (Form 19) to your regional EPFO office, along with a canceled cheque and ID proof.

Consequences of Non-Compliance:

Penalties: Failure to comply with PF regulations can lead to hefty fines and penalties.

Legal Action: Non-compliance can result in legal proceedings, which could damage the company’s reputation and lead to financial losses.

Employee Grievances: Non-compliance can lead to dissatisfaction and grievances among employees, potentially resulting in high attrition rates.

Conclusion

The Provident Fund (PF) is a simple yet powerful savings tool that helps employees secure their future. Not only does it encourages regular savings, but it also provides financial support after retirement.

Moreover, whether you want to check PF balance, withdraw PF amount, or track PF claim status, all these services are available online through the PF portal.

By understanding how the PF system works, as well as its benefits, and how to manage your account, you can plan your finances better and enjoy long-term security.

Ultimately, a well-managed PF account ensures peace of mind and a worry-free retirement.

Frequently Asked Question

How to check PF balance?

You can check your PF balance by visiting the EPFO portal and logging in with your UAN and password. You can also check it through the UMANG app, by sending an SMS “EPFOHO UAN ENG” to 7738299899, or by giving a missed call to 9966044425.

What are the new rules for PF withdrawal?

As per the new PF rules, employees can withdraw up to 75% of their PF balance after one month of unemployment and the remaining 25% after two months. Withdrawals can be made online using your UAN linked with Aadhaar and bank account.

How to withdraw PF amount online?

Go to the EPFO Member Portal and log in with your UAN and password. Select “Online Services,” click on “Claim (Form-31, 19, 10C),” verify your bank details, choose the reason for withdrawal, and submit your claim online.

What is PF?

PF or Provident Fund is a savings scheme managed by the government that helps employees save a portion of their salary every month. Both the employee and employer contribute to the fund, which can be withdrawn after retirement or during emergencies.

How to find PF account number?

You can find your PF account number on your salary slip. It is also available on the EPFO portal when you log in using your UAN. If you are unable to find it, contact your company’s HR department for assistance.