Embracing Cloud Payroll Software: A tale of business transformation

At a bustling café in the heart of the city, two business owners, Alex and Emily, sat across from each other, sipping their coffee and discussing their respective ventures.

Alex: Emily, you won’t believe the impact of cloud-based software on my business! Productivity skyrocketed, and we can access data from anywhere.

Emily: Is it secure, though? I worry about sensitive information.

Alex: Not to worry! Cloud providers prioritize security with encryption and regular backups.

Emily: That’s a relief. But is it cost-effective and scalable for small businesses like mine?

Alex: Absolutely! The initial investment is worthwhile, and it scales effortlessly as your business grows.

Emily: (Curious) Really? Tell me more. I’ve been contemplating upgrading my systems too, but I’m not sure if it’s worth it.

Alex: It’s worth every penny! With cloud-based software, our team can access critical data and applications from anywhere, anytime. No more being tied to the office.

Emily: Impressive! I’m sold. Thanks for sharing your experience, Alex!

Alex: You’re welcome, Emily! Embrace the cloud, and watch your business thrive!

The prevailing sentiment among our cohort inclines towards wholehearted support for Alex and, correspondingly, the Cloud-based Payroll Software. Nevertheless, should any of our esteemed audience dissent from this consensus, I implore you to peruse the forthcoming article for a more comprehensive understanding and perspective on the matter.

Welcome to a realm where traditional payroll processes bow to the magic of cloud-based technology!

In today’s fast-paced and dynamic business world, small enterprises are turning to innovative solutions to streamline their operations and stay ahead of the competition. One such game-changer that has taken the business world by storm is cloud-based payroll software. Picture this: liberating your small business from the shackles of manual payroll processing, and stepping into a world of efficiency, accuracy, and unparalleled convenience.

Join us as we embark on an exciting journey through the incredible benefits of cloud-based payroll software, where the skies are limitless, and your business can soar to new heights!

So, fasten your seatbelts as we unravel the secrets to transforming your payroll experience into a cloud-powered phenomenon!

Cloud payroll refers to a modern and innovative approach to managing an organization’s payroll processes using cloud-based technology. In traditional payroll systems, businesses typically store and process payroll data on-premises using physical servers and software. However, cloud payroll takes this to the next level by moving all payroll-related operations to the cloud.

In essence, cloud payroll software operates over the internet, allowing businesses to access and manage their payroll data and functions from any location with an internet connection. Instead of installing and maintaining software on individual computers or servers, the entire payroll infrastructure is hosted and maintained by a third-party service provider, often referred to as a cloud payroll provider.

Cloud payroll software offers a myriad of benefits for small businesses, empowering them with advanced payroll management capabilities and driving overall operational efficiency. Let’s explore some of the key advantages:

Cloud payroll allows small businesses to access their payroll data and perform essential tasks from anywhere with an internet connection. This level of accessibility ensures that business owners and authorized personnel can manage payroll on the go, even from their mobile devices, providing unparalleled flexibility in managing the workforce.

Cloud-based solutions eliminate the need for expensive on-premises hardware and software installations. Small businesses can opt for subscription-based models, paying only for the services they require. Moreover, as the business grows, cloud payroll systems easily scale to accommodate a growing workforce without incurring significant upfront costs.

Reputable cloud payroll providers invest heavily in data security measures, including encryption, firewalls, and regular backups. This ensures that sensitive payroll information remains protected from unauthorized access and potential data loss. Additionally, many cloud payroll systems are designed to comply with industry regulations and legal requirements, saving small businesses the hassle of managing compliance on their own.

Cloud payroll automates various time-consuming processes, such as calculating salaries, taxes, and deductions. This reduces the manual workload for HR and payroll teams, freeing up valuable time and resources that can be redirected towards more strategic tasks.

Cloud payroll providers handle all software updates and maintenance tasks, ensuring that small businesses are always using the latest and most secure version of the software. This eliminates the need for businesses to manage software updates themselves, saving time and minimizing the risk of system vulnerabilities.

Cloud payroll software often integrates seamlessly with other HR and accounting systems. This enables smooth data flow between different departments, streamlining overall business operations and avoiding data duplication errors.

Automation in cloud payroll reduces the likelihood of human errors that may occur during manual data entry. With accurate calculations and automated tax filing, small businesses can avoid costly mistakes and penalties.

Cloud payroll systems usually offer employee self-service portals, empowering employees to access their payroll information, tax forms, and pay stubs conveniently. This reduces HR’s administrative workload and fosters employee satisfaction by providing easy access to relevant information.

Cloud payroll solutions often come equipped with real-time reporting and analytics features. Small businesses can access meaningful insights into their payroll data, helping them make data-driven decisions to optimize workforce management and budgeting.

Cloud payroll platforms often offer mobile apps, enabling business owners and HR managers to manage payroll tasks even when they are away from their desks, ensuring continuous oversight and control.

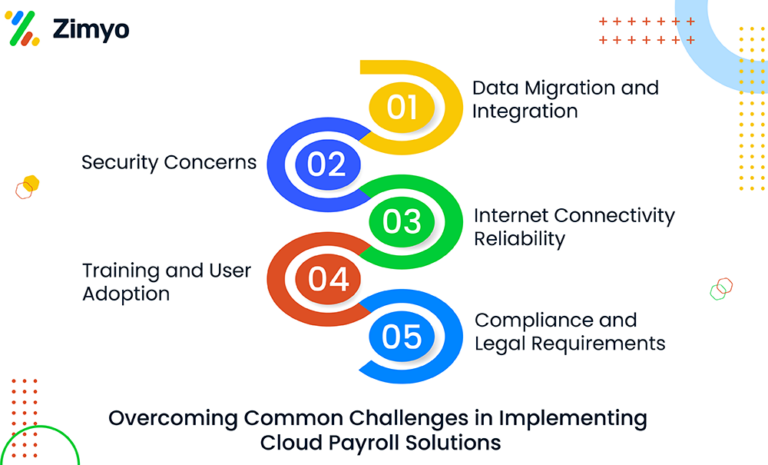

Implementing cloud payroll solutions can significantly enhance a small business’s payroll management efficiency and accuracy. However, like any major technology adoption, challenges may arise during the implementation process. Here are some common challenges and strategies to overcome them:

Transferring existing payroll data to the cloud can be complex, especially if the data is scattered across various systems. To overcome this challenge, businesses should plan meticulously, clean up their data beforehand, and work closely with the cloud payroll provider to ensure seamless data migration and integration.

While cloud payroll systems are generally secure, some businesses may still have reservations about storing sensitive payroll data off-site. To address security concerns, it is crucial to choose a reputable and well-established cloud payroll provider with a strong track record of data protection. Additionally, implementing strong access controls and encryption measures further enhance data security.

Introducing a new cloud payroll system may require employees to adapt to new processes and interfaces. Comprehensive training and clear communication about the benefits of the new system are essential to encourage user adoption. Providing ongoing support and resources can help employees feel more comfortable with the transition.

Different regions and industries have varying payroll regulations and tax laws. Ensuring that the cloud payroll system is compliant with these requirements is vital. The cloud provider should be able to offer compliance features and stay up-to-date with any changes in regulations.

As cloud-based systems rely on internet connectivity, any disruptions in internet service could temporarily hinder payroll operations. Employing backup internet connections and contingency plans can help mitigate the impact of such situations.

By being aware of these common challenges and implementing proactive strategies to address them, small businesses can successfully overcome hurdles and unlock the full potential of cloud payroll solutions for streamlined, efficient, and accurate payroll management.

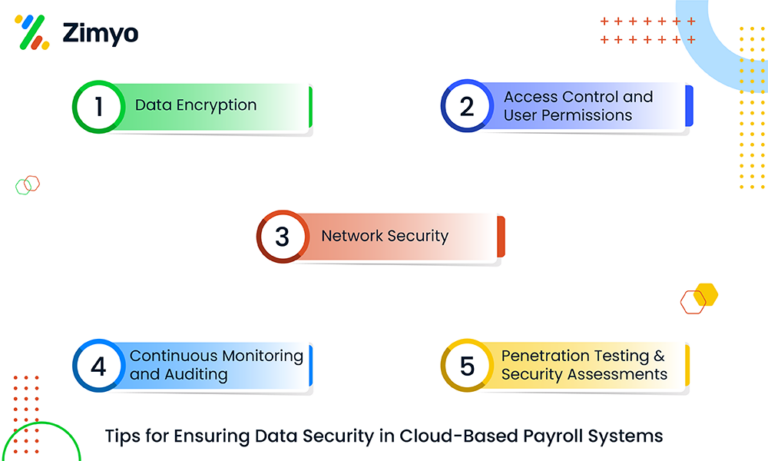

Ensuring data security is paramount when using cloud-based payroll systems, as they handle sensitive employee information, salary details, and tax records. Here are some essential tips to safeguard data in cloud-based payroll systems:

Ensure that all data transmitted to and from the cloud payroll software is encrypted using robust encryption protocols, such as SSL/TLS. Encryption ensures that even if data is intercepted, it remains unreadable and secure.

Verify that the cloud provider employs strong network security measures, such as firewalls and intrusion detection systems, to protect against unauthorized access and cyber threats.

Grant access to the cloud payroll system based on the principle of least privilege. Restrict user access to only the data and functionalities required for their roles. Regularly review and update user permissions as job roles change.

Implement continuous monitoring and auditing of system logs and user activities to detect any unusual or suspicious behavior promptly. Regular audits help identify potential security gaps and address them proactively.

Perform regular penetration testing and security assessments to identify vulnerabilities and weaknesses in the cloud payroll system. Address any discovered issues promptly to enhance security.

By implementing these data security measures, small businesses can rest assured that their sensitive payroll information remains protected in the cloud-based payroll system, safeguarding both their own interests and their employees’ privacy.

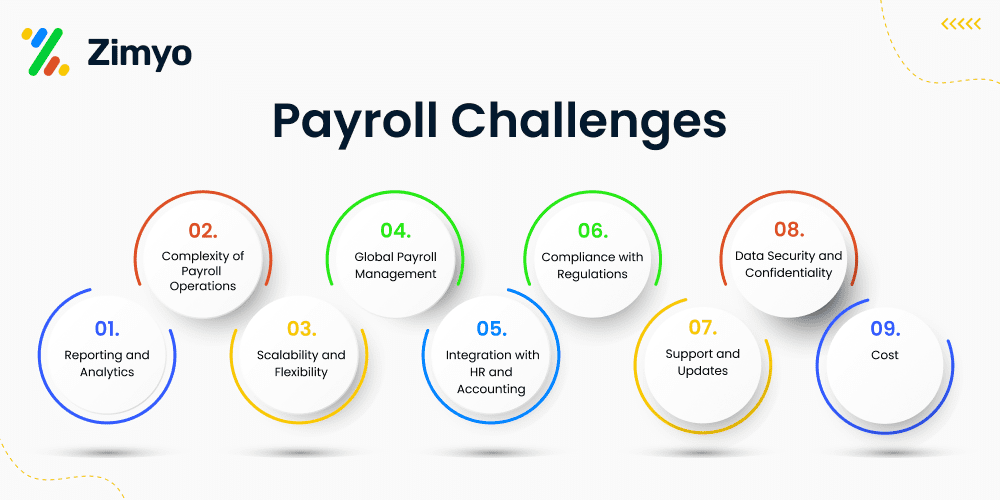

Payroll management is an indispensable aspect of human resources, ensuring accurate and timely compensation to employees. With the advent of technology, two predominant systems have emerged – Cloud Payroll and Traditional Payroll. This comparative analysis aims to shed light on the distinctive features, operational efficiencies, and implications of each approach, assisting businesses in making informed decisions.

Cloud payroll: Cloud-based systems offer unparalleled accessibility, enabling HR professionals to access data from any location with internet connectivity. They also provide effortless scalability, accommodating businesses of various sizes without the need for substantial infrastructure upgrades.

Traditional payroll: Traditional systems typically require on-premises software and hardware, limiting accessibility to the physical office. Scalability may be challenging due to hardware limitations, potentially leading to increased costs and complexities when expanding.

Cloud Payroll: Reputed cloud service providers prioritize robust security measures, including encryption, access controls, and data backups, safeguarding sensitive employee information. Compliance with data protection regulations is also a focal point for most cloud providers.

Traditional Payroll: Data security in traditional systems relies heavily on in-house IT practices, which may not always match the stringent standards of cloud providers. Maintaining compliance with evolving data protection laws can be resource-intensive and may pose risks.

Cloud Payroll: Cloud-based solutions often follow a subscription-based model, reducing upfront costs. Additionally, businesses can scale their usage based on actual requirements, optimizing expenditures.

Traditional Payroll: Initial investments in hardware, software licenses, and IT infrastructure can be substantial. Fixed costs may persist even during periods of low payroll activity, leading to inefficiencies.

Cloud Payroll: Cloud systems typically offer seamless integration with other HR and business software, streamlining data flow and reducing manual data entry. Automation features enhance efficiency, saving time and reducing errors.

Traditional Payroll: Integration with other systems may necessitate custom solutions, leading to higher development costs and potential data discrepancies. HR Automation capabilities may be limited, resulting in increased manual efforts.

Cloud Payroll: Cloud providers typically handle system maintenance, updates, and technical support, reducing the burden on internal IT teams.

Traditional Payroll: In-house IT teams must manage system maintenance and support, diverting resources from core HR functions.

In conclusion, both Cloud Payroll and Traditional Payroll systems offer distinct advantages and challenges. Cloud-based solutions excel in accessibility, scalability, security, and cost-effectiveness, while traditional systems may appeal to businesses seeking more control over their data and processes. Organizations must carefully consider their unique needs and priorities before choosing the most suitable payroll management approach. As technology continues to evolve, staying abreast of innovations and best practices will be pivotal in optimizing HR operations and achieving organizational success.