Dubai Free Zones : Your Gateway to Business Success in the Middle East

Being an entrepreneur considering modern business venture or an existing one looking out to develop your business presence globally, Free zones Dubai is an exciting and driving opportunity for you. It offers a treasure trove of benefits like it evaluates incentives, world-class infrastructure, and an environment friendly to the world of business. In this comprehensive blog, we will jump into everything you need to know about Free Zones Dubai, counting the benefits, setup process, and costs involved, as well as what makes them a global business hub.

DIVE INTO WHAT SPARKS YOUR INTEREST

What Are Free Zones?

Free Zones are those designated areas in the UAE for special business regulation, which could give businesses a unique set of tax and legal advantages compared to business on the mainland. Free Zones point to pull in foreign investment, accelerate economic development, and stimulate international exchange through benefits such as tax exemptions, full foreign ownership, and simplified business registration forms given to companies.

The first Free Zones Dubai, Jebel Ali Free Zone, was built up in 1985 and laid the establishment for today’s Dubai position as a global business hub. Since at that point, more than 40 Free Zones have been built up over the United Arab Emirates catering to fund, technology, media, and numerous other divisions.

Even if you’re seeking a platform for advanced HR software, performance management solutions, or compliance with regulations, Free Zones Dubai provide the perfect launchpad with the diverse range of integrations of industries.

Geographic Distribution of Free Zones in the UAE

The part of Free Zones in global economic recovery has been more critical than ever, particularly in the wake of the widespread. With over 7,000 Free Zones worldwide, these specialized economic zones contribute almost $3,500 billion worth of sends out every year, speaking to nearly 20% of worldwide trade. Additionally, Dubai’s Free Zones play a imperative part in the UAE’s methodology to expand its economy past oil by situating itself as a global leader in innovation and commerce.

Dubai Free Zones: How It Catalyzes Global Recovery

There are a few of the world’s most competitive Free Zones inside the emirates of the UAE. Further, depending on the kind of business action and the target market, different advantages are given by each emirate.

It hosts many Free Zones, making it a leading destination for outside businesses because of its amazing infrastructure, universal connectivity, and policies friendly to investors. Key free zones in Dubai incorporate Jebel Ali Free Zone (JAFZA), Dubai International Financial Centre (DIFC), Dubai Silicon Oasis (DSO), Dubai Media City, and Dubai Internet City. Again, these zones cover a wide range of industries such as finance, media, technology, and coordination’s, advertising various offices, counting office spaces and warehouses, to support business development.

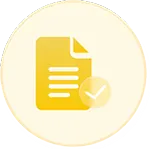

What Makes Dubai Free Zones Unique

Free Zones Dubai have been established with the objective of encouraging and fostering international business and offering many competitive advantages over their mainland counterparts. Some of the most attractive advantages of operating within a Free Zone include:

1. 100% Foreign Ownership

Unlike their mainland counterparts, which require the involvement of a local sponsor, businesses established within Free Zones Dubai allow for full foreign ownership and therefore are popular among international investors.

2. Tax Holidays

Free Zones as a rule give tax holidays between 15 to 50 years; this implies companies are exempt from corporate taxes, income taxes, and capital gains taxes adding to a saving an extra payroll.

3. No Import/Export Duties

Companies working within Free Zones Dubai enjoy an exceptions from customs obligations, thus making them idealize for trading and fabricating businesses engaged in global supply chains.

4. Repatriation of Profits and Capital

No restriction is imposed on the repatriation of profits, capital, or dividends; the funds are absolutely free to be transferred to another country.

5. Quick Business Setup Process

It usually takes a very short period, and few steps compared to the mainland in setting up business within the Free Zone as many Free Zones now provide swift approval, limited paperwork, and online service.

6. Ease of Recruitment

Free Zones Dubai make the hiring process relatively straightforward, often focusing on the attraction of high-caliber workers from anywhere in the world. Also, this offers an extent to make recruitment a hassle-free process.

Advantages of Dubai Free Zones

• Cost-Effective

Free Zones Dubai are considered to be less expensive than most business establishments. There are tax exemptions, no import/export duties, and less administrative costs in comparison to those set up in mainland areas along with 100 % ownership.

• Business Flexibility

Free Zones Dubai permit a business to operate as a sole establishment, a partnership, or a corporation. Typically valuable for all business sizes, be it a freelancer or a multi-national company.

• Access to a Global Market

The UAE’s strategic area makes it a gateway to Middle Eastern, African, and Asian markets. Moreover, Free Zones give access to Dubai’s vast transportation infrastructure, counting the world’s busiest airport, the biggest port in the locale, and world-class logistics networks.

• Networking

Free Zones Dubai offer a business built with like-minded entrepreneurs and investors. With multiple aligned events, seminars, and exhibitions, diverse businesses connect partnerships with others inside the same or related industries.

• Infrastructure

Free Zones Dubai are characterized by their state-of-the-art infrastructure. Also, businesses have access to predominant workplaces, present day technology, and facilities designed to assist businesses expand and grow quickly.

Dubai Free Zones vs. Mainland: What's the Difference?

Albeit Dubai Free Zones offer an unending list of advantages, the truth is that Free Zone businesses and mainland businesses differ in some important respects. As such, knowing this aspect better can help entrepreneurs choose the best for their business.

Feature | Dubai Free Zone | Dubai Mainland |

Ownership | 100% foreign ownership | Maximum 49% foreign ownership |

Business Scope | Free Zone as well as foreign trade | The business could operate in UAE |

Office Space | Flexible options like virtual offices | Must have a physical office (minimum 200 sq ft) |

Licensing | Simple and quick | Requires clearance from multiple government bodies |

Visas | Subject to Free Zone authority | Based on the size of the office space |

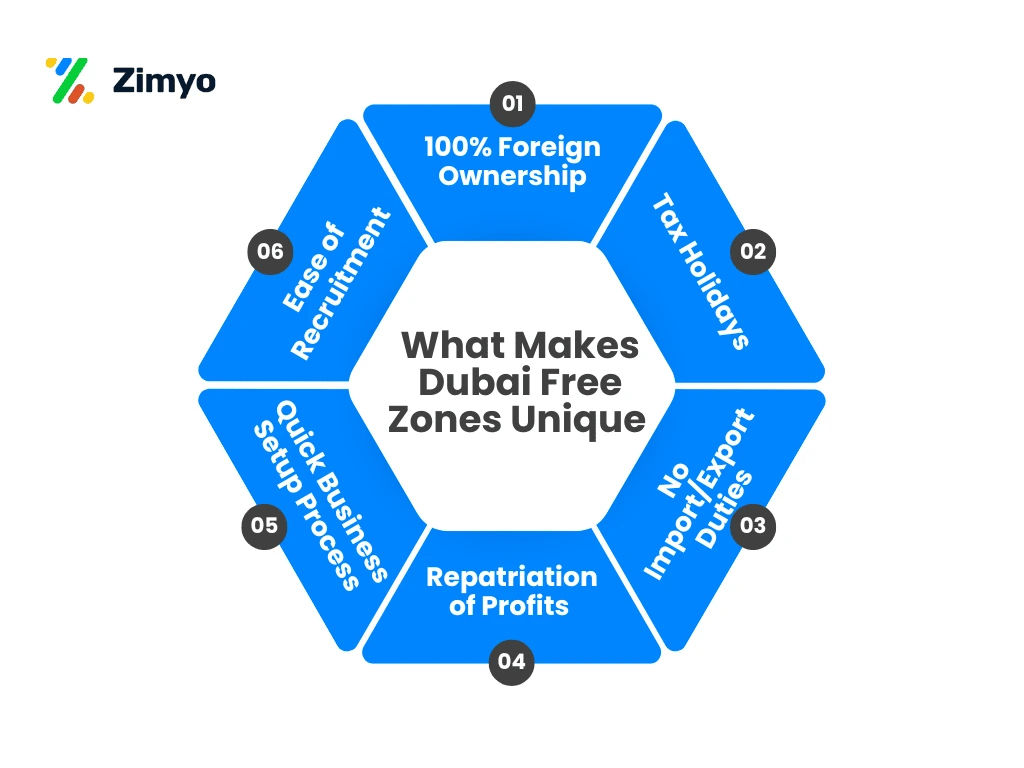

Dubai Free Zones Business Licenses

Industrial License

It applies to manufacturing and production-based businesses.

Professional License

Companies involved in professional services such as consultancy, legal services, or IT services are under this license.

Freelancer License

For individuals offering independent services, which is a more flexible license.

E-Commerce License

These are for online sales and trading businesses.

Tourism License

For travel agencies, tour operators, and similar services.

Commercial License

For trading, retail, and wholesale companies.

All Free Zones have defined requirements for granting licenses depending upon the nature of business, and most Free Zones Dubai offer tailor-made facilities in conformity with individual needs.

Costing Required for Starting a Business

The costs for setting up a business in Free Zones Dubai will change from AED 9,000 to AED 10,000, depending on the legal structure, business action, and particular Free Zone you choose. It might get vary as per the factors. Additionally, this incorporates the cost of registration, licensing expenses, and other minor administrative charges. Although the investment is quite minimal, office space, employee visas, and operational costs need to be taken into account.

Is Dubai Free Zone Tax-Free?

Free Zones Dubai are renowned for being tax friendly. Businesses in qualifying Free Zones usually pay a 0% corporate tax rate on qualifying income, while other taxable income attracts a 9% tax. Moreover, proposition for international entrepreneurs and investors does not include any tax on capital gains or personal income.

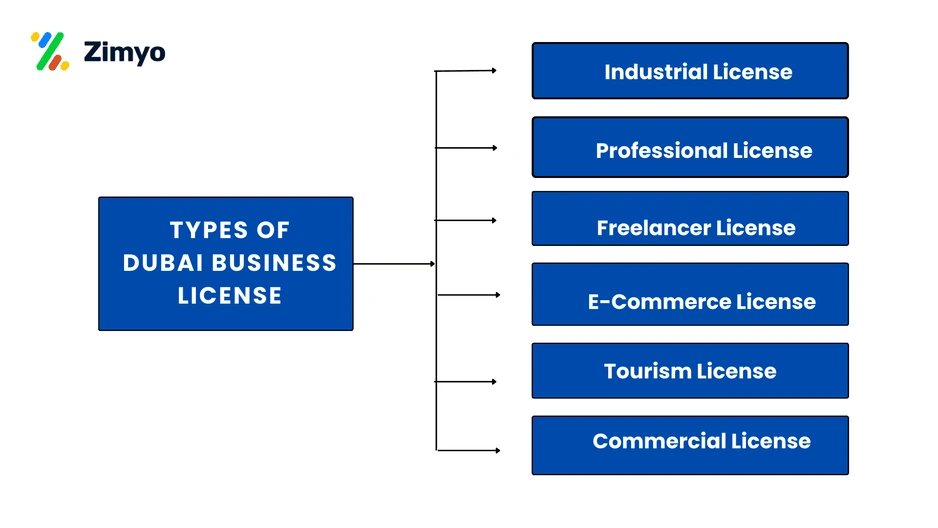

Different Types of Legal Entities in Free Zones Dubai

Setting up a business in Free Zones Dubai gives you two choices, and each of them is planned to meet diverse types of business needs. Further, these two options incorporate:

1. Free Zone Company (FZCO):

A Free Zone Company (FZCO) is like a Free Zone Limited Liability Company (FZ LLC) but has a key difference: It has more than 50 shareholders. This structure is useful for businesses with a broader ownership base and is perfect for companies looking to invite a wide run of investors or accomplices. Furthermore, a Free Zone Company must appoint at the slightest one director and one secretary, guaranteeing proper governance and operational oversight. Also, this structure offers flexibility, permitting businesses to pursue expansion techniques and joint ventures with greater ease.

2. Free Zone Foundation (FZE)

A Free Zone Foundation (FZE) could be an easier structure planned for people or corporate substances that wish to set up a commerce with a single shareholder. This setup offers a direct proprietorship demonstration, perfect for businesspeople or little trade proprietors who look for coordinate control over their operations. Moreover, the FZE structure simplifies decision-making and governance, making it a popular choice for sole proprietors and startups. An FZCO and an FZE differ according to the structure, size, and long-term vision of your business. Additionally, FZCO suits bigger businesses that are owned by many shareholders. For entrepreneurs seeking ease and total ownership, FZE is better.

Setting Up Business in Free Zones Dubai

The process of forming a business within Free Zones Dubai can often be streamlined and efficient. Let’s break this down into a series of primary steps to begin your venture.

• Determine Your Business Entity Type

Start by identifying the type of legal entity suitable for your objectives and ownership expectations. Also, this sets up the organizational form and character of your firm, which affects its operations inside the Free Zone Dubai.

• Select a Trade Name

Select an appropriate business name that is allowed under the rules and regulations of the UAE. It must be unique and must meet the requirements to be eligible under the naming guidelines of the UAE government.

• Obtaining Business License

Apply for a business license under the Free Zone jurisdiction you selected and the nature of your business activity. For some, this will require presenting a business plan with the application.

• Select Office Location

Free Zones Dubai offer a range of office options, from flexi-desks to fully serviced offices. Further, choose one that suits your business size and requirements, especially if you are just starting.

• Obtain Pre-Approvals, Register Your Business, and Receive Your License

After processing your application, the Free Zone authority issues you with a pre-approval for registration, where it officially gets registered with all its requirements completed. Moreover, on receiving your license from the relevant registration, your trade license becomes legal and lets you begin formal operation.

• Opening Corporate Bank Account in Dubai

Open up a corporate account within the name of the recently joined business inside Dubai to guarantee smooth finance and exchange operations for your new company. Once you’ve completed these steps, your business is prepared to launch in the Dubai Free Zone. Also, the complete process can take only many weeks, depending on the Free Zone authority.

Requirements for Initial Approval, Registration, Licensing, and Visa Processing in Free Zones Dubai

The documents needed for the process of initial approval, registration, licensing, and visa vary among Free Zones as well as type of business. Generally, an application form filled in properly with the following details is submitted Colored passport copies of company shareholders and Appointed manager/director. Further, where the applicants reside in the UAE, copies of Emirates ID, and UAE Residence Visa. Some Free Zones require a business plan or financial reports for businesses, depending on the size of the business. Also, Letters of intent might be needed in some cases depending on the Free Zone Dubai and business activity.

Once preparatory endorsement is given by the Free Zone authority, they will get ready your lease agreement, issue your trade license, and begin processing employee visas. Then, all Free Zones are diverse so guarantee to confirm specifics with the Free Zone in question so that you simply can get everything you need together.

This streamlined handle ensures that entrepreneurs and investors can rapidly establish and work their businesses in Free Zones Dubai, harvesting the region’s assess incentives, modern framework, and global network.

Free Zones in Dubai List

- Dubai Internet City

- Dubai Healthcare City

- Dubai Knowledge Park

- Dubai International Financial Centre

- Dubai Silicon Oasis

- Dubai Studio City

- Dubai Multi Commodities Centre (DMCC)

- Dubai Design District (D3)

- Dubai Media City

- Jebel Ali Free Zone

- Dubai Outsource City

- Dubai South

- Sharjah Airport International Free Zone (SAIF Zone)

- Meydan Free Zone

- Dubai World Trade Centre

- Dubai Airport Free Zone

- Dubai Science Park

- Ajman Free Zone

- International Humanitarian City

- Dubai Production City

- Hamriyah Free Zone

- Umm Al Quwain Free Trade Zone

- Dubai Maritime City

- Dubai International Academic City

Future Trends in Dubai Free Zones

Free Zones Dubai are continuously advancing to keep pace with worldwide trends. Some emerging patterns include:

• Technology and Innovation

Free Zones Dubai are embracing the most recent technologies such as AI, blockchain, and cloud computing as the global tech industry extends to empower tech startups and digital businesses.

• Sustainability

As global issues of sustainability have been rising, Free Zones Dubai are progressively concerned with green activities, giving companies ecologically inviting infrastructure and fostering eco-friendly business practices.

• E-commerce Expansion

Fast expansion in e-commerce created a new opportunity, so free zones began to focus on digital businesses. Moreover, free Zones began to join the wagon of digitization by adding assistance in logistics, warehousing, and international trade services.

Conclusion

Free Zones Dubai are a tremendous business prospect for a company to develop and in the long run expand into international markets.

Whether you’re an entrepreneur looking for 100% outside ownership or an already established company that looks for charge incentives and get to global markets, Dubai Free Zones are a perfect environment. Because of tax exemptions, disentangled forms, and special industries, Free Zones Dubai remain an indispensably component of Dubai as a global business center offering a platform and further this businesses ca be well managed through the HR software. You can Schedule a demo for the same. If you’re considering starting a business in Dubai, a Free Zone might just be your ideal launchpad.

Frequently Asked Questions (FAQs)

Free Zones are those designated areas in the UAE for special business regulation, which could give businesses a unique set of tax and legal advantages compared to business on the mainland.

Dubai Free Zones includes a list of best free zone

- Jebel Ali Free Zone (JAFZA)

- Dubai Multi Commodities Centre (DMCC)

- Dubai Airport Free Zone (DAFZA)

- Dubai Internet City (DIC)

- Dubai Media City (DMC)

The Corporate Tax Law empowers a Qualifying Free Zone Person to enjoy a 0% Corporate Tax rate on their Qualifying Income.

Mainland companies have the flexibility to function anywhere in the UAE without restrictions. On the other hand, Free Zone companies are restricted to working inside the Free Zone or internationally, unless they accomplice with a nearby distributor. To conduct trade in territory UAE, they must obtain a No Objection Certificate (NOC) from the Department of Economic Development (DET).