Introduction to Egypt Labor Law

The labor market in Egypt has essentially changed over the past few years, with the Egyptian government. This acknowledge the need to modernize its labor law to support employees and managers alike. This law aims at enhancing the balance between the workforce and employers and increasing Egypt’s economic competitiveness.

In any case, mastering the craftsmanship of scaling a business viably while navigating the complexities of Egypt labor law remains a basic challenge for responsible employers.

Egypt, being the third-largest populace in the world and Africa’s second-largest city, is hub for remote investment. Egyptian labor and company laws combine cutting edge practices with Islamic Sharia law. Also, the legal system is with a hierarchy of courts and independent judges. Further, progressing changes focuses on improving transparency, productivity, and cultivating investor certainty. Initiatives like “Egypt Vision 2030” and the “New Investment Law” reflect the country’s commitment to many initiatives. These includes innovation, boosting competition, and progressing economic differences.

Moreover, the Egypt Labor Law 2025 is a vital device for setting up a reasonable, equitable, and international labor standards-compliant work environment. Thus, this blog delves into the most important updates and modifications in the 2025 version, focusing on how businesses and employees must navigate this evolving legal landscape.

Egypt Labor Law Regulations

The essential legislation governing labor relations in Egypt is Labor Law 12 of 2003, as amended by Law 180 of 2008. This law diagrams the system for interactions between managers and employees inside Egypt’s private sector.

Further, Egypt Labor Law covers essential work conditions, such as working hours, rest periods, overtime compensation, and other key perspectives of the working environment, which are detailed further below.

Also, Social Security Law 79/1975 and the Civil Law Code primarily regulate employee protections and benefits.

Developments in Egypt Labor Law

The Egypt Labor Law includes the following significant provisions in respect of present trends in employment with the safety and protection of employees’ rights in mind. So, significant changes and new provisions include the following:

- Employment Contracts

- Leave Policies

- Working Hours and Rest Periods

- Wages and Compensation

- Health and Safety Regulations

- Dispute Resolution and Arbitration

- Termination and Severance Benefits

- Employee Rights in Specialized Sectors

Let’s engage in these areas to understand their impact on both employers and employees in Egypt.

1. Employment Contracts in Egypt Labor Law

The employment contract is the backbone of the Egypt Labor Law, which comes from legally and documents the terms that characterize a working relationship between an employer and an employee. Also, the law requires all contracts in written form and include all the necessary requirements. Therefore, this means that in the new provisions, employers and employees can negotiate more flexible arrangements.

Probation in Egypt

Probation in Egypt limits to the 3 months.

• Permanent Contracts

Permanent contract is the most common type that offers the greatest employee security. Generally, it alludes to a long-term and renewable contract where there’s no specific end date.

• Fixed-Term Contracts

Further, these are contracts that exist for specific jobs, projects, or time ranges. Moreover, Fixed-term contracts gets at the end of the contract, but when they last for more than two years, counts permanent.

• Part-Time Contracts

This law accepts the growing need for part-time work, basically by businesses such as retailers, hospitality, and education. Also part-time worker gets proportional benefits on an hour-for-hour basis.

Overall, The Egypt labor law too states that an employee cannot do more than one job at a time unless the contract states otherwise

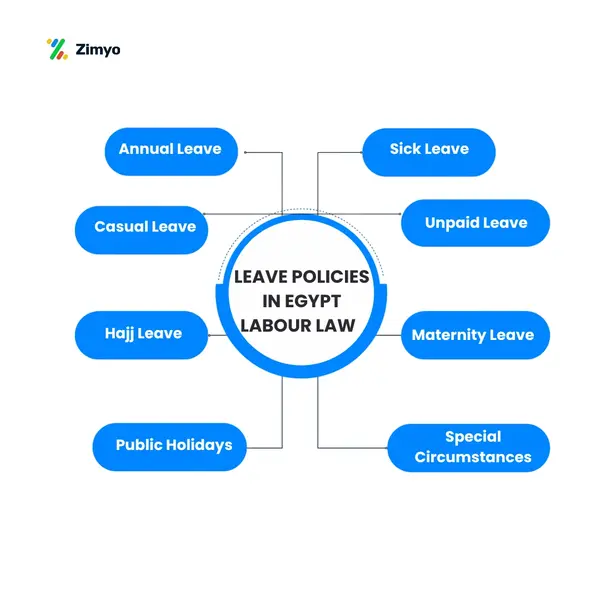

2. Leave Policies under Egypt Labor Law

• Annual Leave

Those who have completed a full year of work with the same employer gets 21 days of paid annual take-off. Moreover, within the fifth year of employment, the privilege will expand to 30 days. Further, Take-off can get forward for a period not surpassing two a long time if the employee is unable to take leave in the calendar year.

• Sick Leave

Employees who drop sick and cannot work gets 1800 days of paid wiped out leave per year as per Egypt labor law. In any case, the pay structure is as follows:

- First 15 days: Full pay

- Next 30 days: Half pay

- Following 45 days: Unpaid

• Casual leave

Article 51 of the Labor Law states that abstaining from work for casual reasons should not exceed a period of six days per year where each discrete time shall not exceed two working days.

• Maternity Leave

Female employees get to 90 days paid maternity leave. They fully pay the first 45 days, and they half pay the remainder. Moreover, the women got save by no liberty to dismiss or take any adverse action against them during their maternity leave.

• Public Holidays

- The public holidays in Egypt have certain law that combines with work conditions.

- Since Islamic occasions are according to on the lunar calendar, their dates alter each year.

- Employees who work on national holidays can get 300 times their standard daily salary.

• Additional Types of Leave

- Hajj Leave (Pilgrimage Leave): Employees makes to a one-time fully paid leave to perform the Hajj pilgrimage during their employment.

- Leave for Special Circumstances: Also, employees may receive short-term paid leave for specific life events, such as marriage, exams, or the death of immediate family members. So, the exact terms may vary based on employment contracts or company policies.

- Unpaid Leave: Although not legally mandated, employers may offer unpaid leave for extended personal reasons, provided employer approves it.

3. Working Hours and Rest Periods in Egypt Labor Law

• Standard Working Hours

The law establishes that employees are to work no more than 48 hours a week, typically divided into six working days of 8 hours each. In any case, certain industries or sectors may negotiate reduced working hours in line with business prerequisites.

• Overtime

Those employees who work more than the standard 48 hours gets to overtime minutes’ pay. Employers generally compensate overtime at a rate of 1.5 times the employee’s hourly wage. For work done at the end of the week or public holidays, employees must get compensation at twice their normal hourly rate as per egypt labor law.

• Rest periods

Employees gets at least 30 minutes of break in every 6 consecutive hours of work. Also, employees might also get satisfactory rest days whereby they get a paid day off each week.

• Night Work

Those who work at midnight, usually from 10 PM to 6 AM, get a few additional recompenses. Thus, night work overtime as a rule pulls in 1.5 times the basic rate per hour.

4. Wages and Compensation

• Salary Payments

Salary must be paid straightforwardly to the employee in Egyptian pounds as egypt labor law or any other money agreed upon in the work contract. Further, the payment should get routinely, ideally monthly, and through coordinate bank transfer or any other method agreed upon.

• Minimum Wage

Whereas there’s no explicit minimum wage law, the Egyptian government has presented least wage proposals for various segments. Especially it is in public administration as per egypt labor law. Further, these suggestions are frequently reviewed to guarantee that employees makes in line with the inflation rate and cost of living.

Salary disbursement in a few clicks

5. Health and Safety Regulations

The Egypt Labor Law gives for workers’ protection from potential workplace risks. Moreover, the bosses gets appoint by the law to make a secure working environment and take all reasonable steps to avoid accidents and injuries.

• Workplace Safety

The managers are responsible for guaranteeing that all equipment, machinery, and tools are there to security standards. With Egypt Labor Law for high-risk industries, such as construction or fabricating, managers should implement additional safety measures. These measures includes provision of individual protective equipment and regular safety training.

• Medical Care

In any dangerous trade, the employers shall offer employees health services. Additionally, workers’ compensation insurance must be made to their workers, thus protecting any employees’ medical charges arising from workplace injury.

• Emergency Protocols

There must be emergency protocols established by the employers. Also, the protocols must be regarding fire safety and evacuation procedures. Furthermore, the employees should educate themselves about these emergency procedures.

6. Dispute Resolution in Egypt Labor Law 2025

Disputes between employers and employees are inescapable, and the Egypt Labor Law gives a system for settling such conflicts. Further, the law emphasizes the importance of intervention and arbitration to guarantee fair treatment for all parties included.

- Complaints relating to unpaid wages, wrongful termination, or work-related badgering should get register with the Ministry of Manpower and Immigration (MOMI). The MOMI might examine the complaint and try to solve the case by way of mediation.

- Mediation and Arbitration: In case of a conflict, the MOMI will mediate between the employee and boss so that circumstance is amicably settled. If mediation comes up short to yield comes about, the case moves for assertion or before the labor court.

- Labor Courts: Labor courts are another very important court where disputes cannot get amicably through mediation. The case will be analyzed by the labor court, listened to by both parties, and then a binding judgment will be made. Employees who feel they were unfairly dismissed or have unresolved issues with compensation may appeal to the labor courts for justice.

7. Termination and Severance Benefits

Provisions that protect both the employer and the employee entirely secure the termination of work. Additionally, the manager should, therefore, take proper procedures as per Egypt labor law in rejecting a worker to ensure that the method is fair and legal.

• Notice Period

Employees must be given appropriate notice when their employment is terminated. The length of the notice period depends on the terms of the business contract but generally ranges from 30 to 90 days.

Reduance pay includes minimum salary of 2 months of per year employment.

• Severance Pay

In the occasion of summary dismissal or retirement after having been persistently utilized for more than one year, the company will provide employees with severance pay according to length of service. Overall, severance pays will get on one-twelfth of one month’s compensation per year of benefit.

• Unfair dismissal

Where a representative feels they are unfairly dismissed, they can report the issue to the Ministry of Manpower. If the specialist feels that the dismissal was unjustified, they has the right to compensation, counting reinstatement or top-up severance pay.

Stay compliant, stay informed

Work Permits and VISA

In Egypt, foreign nationals must get the appropriate work permits and visas to lawfully work in the nation. These permits and visas are given by Egypt labor laws. Also it includes Labor Law No. 12 of 2003 and the Foreigners Employment Law (Law No. 72 of 2017). Here’s an outline of the types of work licenses and visas:

- Work Permit: Foreigners employed in Egypt must get a work permit from the Ministry of Manpower and Immigration. The boss must yield documentation proving that the position cannot be filled by a nearby Egyptian specialist. A work permit is typically issued for a period of 1-3 years and is renewable, but only a limited number of grants are given every year depending on the sector and the company’s needs.

- Employment Visa: A foreign worker requires a work visa to work in Egypt. This visa is ordinarily substantial for up to one year and must get renews. Also, the method involves submitting a visa application through the Egyptian office or embassy within the worker’s home country. To apply, the manager must give a contract and proof of a work permit approval.

- Temporary Work Permit: This permit needs for foreign nationals coming to Egypt for a short-term assignment or project. Typically, a few months are issued to complete a particular task or project, and the employer must provide the scope of work along with essential documentation to obtain this permit.

- Freelancer Permit: Self-employed foreign nationals offering services in Egypt must apply for a freelancer permit. This allows people to work on a contract basis with multiple clients. Proof of business registration and contracts with clients are there to get the permit.

- Investor Permit: Foreign investors who wish to function their own businesses in Egypt must apply for an investor permit, allowing them to work in their claim company. This allow requires proof of the investment and company registration, together with other documentation.

- Specialized Worker Permit: Foreign nationals with specialized skills gets a permit to work in specific areas or industries. Employers must illustrate that the skills needs for the position cannot get locally and give fundamental documentation to the Ministry of Manpower.

- Part-time Work Permit: Foreign workers who are contracted on part-time contracts needs to apply for this permit, which permits them to work less hours compared to full-time employees. The manager must give details around the working hours and job duties.

- Student Work Permit: Foreign students residing in Egypt on a student visa may apply for a student work permit to work part-time amid their stay as per Egypt labor law. This allows limits the number of hours students can work and the sorts of jobs they can undertake.

- Mission Visa: Foreign nationals on temporary assignments or short-term missions in Egypt must obtain a mission visa. This visa is for ventures and incorporates a limited term based on the assignment.

Compliance and Documentation: Employers must comply with labor market controls. Moreover, it must illustrate that there are no qualified Egyptian candidates available for the position before contracting a foreign national. Also, all remote representatives are required to supply valid employment contracts, proof of qualifications, and sometimes experience a restorative examination. The Ministry of Manpower is dependable for issuing work permits and ensuring compliance with local Egypt labor laws.

Failure to comply with the controls can lead to penalties for both the employee and employer, including fines or revocation of permits.

Establishing a legal entity in Egypt

Setting up a legal entity in Egypt has traditionally been challenging, with the nation ranked 114th all-inclusive in terms of ease of doing trade. However, later reforms with Egypt labor law have made the method more accessible.

The General Authority for Investment and Free Zones (GAFI) directs company registration, which is now available online. Changes have eliminated or reduced capital requirements, especially for small businesses, and the presentation of “One-Stop Shops” has streamlined the process. Moreover, the government is effectively working to draw in foreign investment by advertising benefits such as facilitating the repatriation of profits.

Whereas some businesses have investment restrictions, various types of visas—including business, work, and residency—have diverse eligibility criteria.

Further, common company structures in Egypt incorporate One-Person Companies, Joint-Stock Companies, and Restricted Risk Companies.

Conclusion

The Egypt Labor Law 2025 is the best comprehensive regulation set forward, and it promotes both the better rights and protection for the employees, making the work environment fair and balanced. These concerns are to include employment contracts, working hours, wages, health and safety, and resolving any disputes; by this, employers and employees have clear framework to go with for the correct payroll.

In turn, there’s much about Egypt labor laws one should be keenly aware of and take proper understanding before establishing such expansion as one must always see it done effectively yet to its standards with law observance.

With this in mind, its comprehensive HR solutions empower organizations in Egypt to efficiently oversee employee contracts and ensure compliance with the country’s labor laws. Through this HR software, businesses in Egypt can develop a work environment that contributes positively to the nation’s economy.

Elevate your overall employee experience

Frequently Asked Questions (FAQs)

There are diverse labor laws in Egypt for the multiple provisions extending the different set of rules.

- Employment Contracts

- Leave Policies

- Working Hours and Rest Periods

- Wages and Compensation

- Health and Safety Regulations

- Dispute Resolution and Arbitration

- Termination and Severance Benefits

- Employee Rights in Specialized Sectors

The Manager will give the Worker with 21 days of annual leave after completing 6 months of business (as per Article 47 of the Egyptian Work Law). After 10 years of benefit, the Manager will give the Employee 30 days of annual leave (as per Article 47 of the Egyptian Labour Law).

Those employees who work more than the standard 48 hours gets to overtime minutes’ pay. Employers generally compensate overtime at a rate of 1.5 times the employee’s hourly wage.

Whereas there’s no explicit minimum wage law, the Egyptian government has presented least wage proposals for various segments.