It’s that time of the month again. To dive deep into the payroll register and double-check, every little detail which relates to payroll reconciliation.☹️ It is important for an organization to process the payroll on time and without any errors. Doing so will develop trust among the employees and the organization.?

Payroll reconciliation is mundane and repetitive. However, at the same time it is the most crucial task for any organization. Therefore, the possibilities of error during payroll reconciliation are endless. It is important to understand how you can perform payroll reconciliation in a correct and efficient manner.✅

Setting up a process that works for your organization can help in saving crucial man-hours. Moreover, it will also help the organization function in a systematic manner.

What Is Payroll Reconciliation?

It means that the total amount you are planning to provide your employees exactly matches the amount you paid them the previous month. In simple terms, you double-check the calculation and eliminate the anomalies, if any. Therefore, your employees do not receive less/more than promised.?

Payroll Reconciliation Process

Having a payroll reconciliation process in place can help the HR team by cutting down on the ifs and buts. An efficient Payroll reconciliation process comprises 4 crucial steps:-?

➡️ Assess Your Payroll Data

The very first step is to evaluate your archives containing details of the payroll period. If there is a difference between the past and present payroll data, you should check for various factors like the elimination of an employee, new employee onboarding, bonuses, incentives, etc. These factors could be the reason for the difference in payroll numbers. ?

➡️ Analyze Salaries As Well As Pay Rates

The next step in the process is to review the salary and pay rates of your employees. For a new employee, bonuses can be a factor for the difference in the numbers. ?

➡️ Keep An Eye On Working Hours

You must double check to make sure that all the employee’s working hours are mapped correctly including overtime. Sometimes errors in overtime calculation can interfere with the whole payroll reconciliation process.

➡️ All Deductions Should Be Accurate

Sometimes tax deductions, LOP (Loss of Pay) deductions, etc. are inaccurately entered in the system which could be a major reason for the difference. Include this step in your payroll reconciliation process to be accurate and thorough.

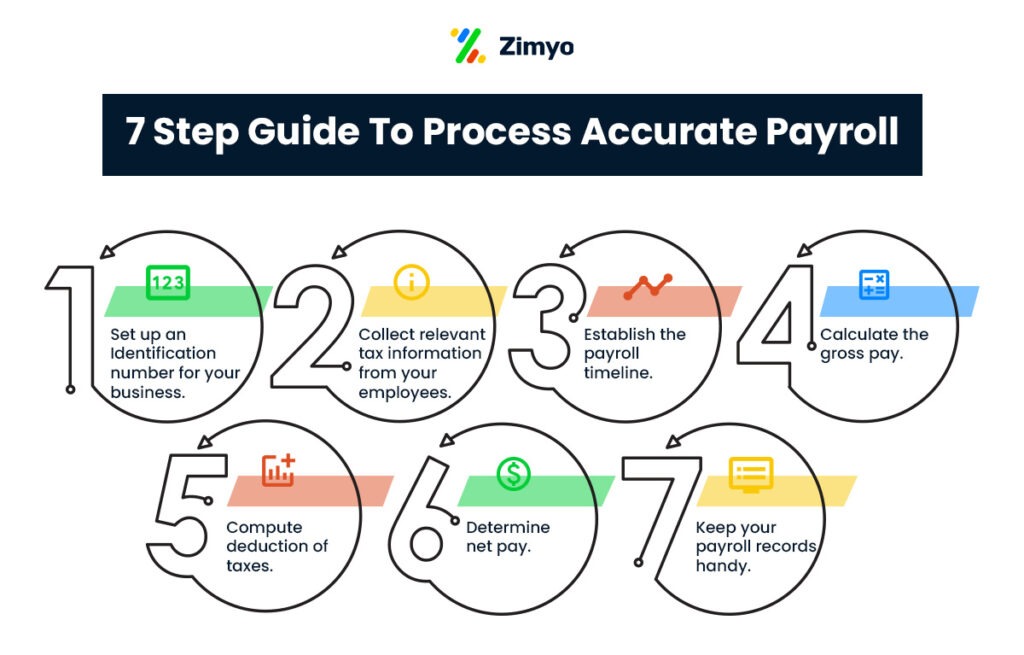

7 Step Guide To Process Accurate Payroll

The responsibility of running the payroll comes after establishing a payroll reconciliation process.

Follow the 7 steps below to process your payroll:-?

➡️ Step 1- Setting Up An Identification Number For Your Business

The very first step is to establish an EIN number as well as your state and local IDs. This data helps the government in keeping a track of your payroll taxes and makes sure you are following the guidelines.

➡️ Step 2- Collecting Relevant Tax Information From Your Employees

This step of the payroll checklist requires you to collect all the tax information of your employees. Every state has a different set of forms and guidelines in place for payroll processing so, filling out all the necessary paperwork before running the payroll is mandatory.

➡️ Step 3- Establish The Payroll Timeline

In this step, you need to understand and establish a timeline for your payroll processing. There are majorly 4 types of payroll processing:-?

- Monthly

- Weekly

- Daily

- Hourly

You need to figure out which of the above-mentioned timeline works best for you and make it a standard practice to run the payroll within the set timeline. ⏳

➡️ Step 4 – Calculating The Gross Pay

After establishing a timeline, comes calculating an employee’s gross pay. The gross pay will also include any overtime pay for an employee.

➡️ Step 5- Deduction Of Taxes

After calculating the gross pay you need to calculate the tax deductions. Tax payments like PF, ESI, etc need to be deducted in order to process an accurate payroll.

➡️ Step 6- Determining Net Pay

After deducting the taxes from your employee’s gross pay, you will be left with the net pay of your employees. This is also known as Cash in Hand. This is the amount your employee will receive a month on month as his salary/payroll.

➡️ Step 7- Keep Your Payroll Records Handy

After distributing the payroll, you need to keep the data or payroll records for future payroll reconciliation purposes. This will help you in matching the data month on month and will also be a crucial part of any audit sessions.

Using an automated payroll solution will make the payroll process easier as all the calculations will be done automatically month on month. Apart from that, all the archives and reports for future payroll reconciliation will also be preserved. Let’s understand how an automated solution will help your business.

Step By Step Guide To Process Accurate Payroll With An Automated Solution

With the help of the right tools, you can process your payroll with the utmost ease and accuracy. ? If you are a first time user or a newbie you need to map the details mentioned below to maintain a perfect payroll checklist:-?

➡️Step 1 – Configuring Company Details

The very first step on the payroll checklist is to configure all your company details. These include: ?

- Payout Settings- This includes mapping the payroll frequency, pay cycle, etc. according to your organization.

- Company Information- This includes mapping your company’s official details, bank details, and Registration information like PTRC number, etc.

- FNF Configuration- This includes mapping the full and final settlement of any employee.

- PF and ESI Calculation- This means establishing and mapping the PF and ESI rules like a maximum tap on PF, monthly eligibility of ESI, etc.

- Salary Slip Template – This means you can save a template for salary slip which will be shared with the employees on a recurring basis.

- Overtime Settings- This means you can map and define your organization’s overtime rules, for eg- hourly calculations, day-wise calculations, etc.

- Salary Component- This includes 3 components- Basic, HRA, and Others.

- Salary Structure – You can define your salary structure by mapping the deductions, earnings, compliances, allowances, etc. for your employees.

- Leave Adjustment- This means you can map your organization’s leave policies.

- Loans and Advance- You can define and map the rules for loans and advance you provide to your employees, this will automatically be included in your payroll process.

➡️ Step 2 – Running The Payroll

The next step in the Payroll checklist is running the payroll. Running payroll is a 3 step process with Zimyo payroll software.

➡️ Step 3 – Freezing The Payroll

After the payroll is completed, it is now time to freeze it. Doing so will help you in reconciling the payroll for future months because you can not reconcile payroll if you do not have the data for previous months. It is important to go through the summary of payroll and then freeze the payroll for future analysis. ?

Lightning-Fast Payroll Process For Our Users

At Zimyo, we have made sure that you don’t have to repeat the same process of configuring the company details every month. ✅ If you are a veteran user you just have to process the payroll and freeze it (step 2 and step 3). Everything else will be done and calculated automatically by Zimyo’s Payroll Solution.?

Conclusion

Running the payroll is a tedious process but with the help of the right tools, you can automate this task and make it less time-consuming and boring. A payroll software’s core function is to set up a systematic workflow for running accurate payroll month on month without any delay for any organization.

The automation of payroll processing will help in decreasing the pressure for your HR team and will also result in resolving errors, if any, as quickly and smoothly as possible.?

Maintaining a proper workflow for payroll reconciliation and following a payroll checklist (step by step guide to run accurate payroll) will decrease the chances of accidental tax frauds and make sure the right amount of taxes are paid year on year. An automated payroll solution can help in preparing your organization for the workplace of tomorrow.??

Quick links – Payroll software in Delhi

Also Read: Make Your Payroll Process More Efficient With These Tips