Before running the payroll process in Qatar there are certain things you need to consider such as registration with the wage protection system (WPS), ensuring payments are in Qatari Riyal (QAR), verifying the working hours of employees and calculating overtime payment. So, this can be well managed with time and attendance management software in Qatar.

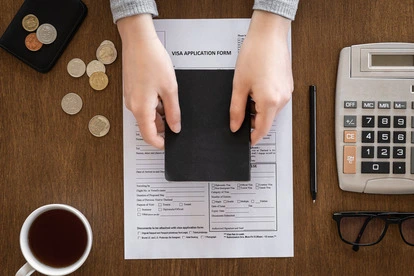

According to labour law in Qatar, employee salary payments must be done using a wage protection system (WPS). Employees should receive their salaries at least once a month and other contracts should commit at least every two weeks. Also, all companies must utilise the WPS for payment within seven days of the due date.

Payroll Process Guidelines In Qatar

The payroll process in Qatar includes using the wage protection system (WPS) to pay employees of the organisation, paying them in Qatar Riyal (QAR) and paying them on time. Therefore, let us elaborate on these for better understanding.

• Wage Protection System (WPS) in Qatar

The WPS in Qatar is an electronic system that ensures employees receive their salaries on time. This system was made by the Qatar Central Bank (QCB). Further, certain important things that are important about this system are:

- The WPS allows organisations to pay their employees through banks.

- The WPS processes salary files to credit salaries to employee’s bank accounts.

- The WPS creates a database that records wage payments in the private sector.

- All companies apply this system except government entities, embassies and petroleum companies.

- This system safeguards the rights of employees to receive their salaries on time and as per the contract.

Companies can register for WPS online and can download a registration form. Also, after filling in the company’s details you need to sign it and submit it to your bank.

• Other Things About Payroll Process In Qatar

Some other things and points that should be overviwed are:

Payment Frequency And Currency

Some important things to note down as per Qatar employment law for payment frequency and currency are below-

- Employees must be paid at least once a month according to their annual or monthly contracts.

- Other employees must be paid at least once every two weeks.

- Payments must be made within seven days of the end of the pay period.

- Payments must be made in Qatar Riyal (QAR).

Moving forward to understand the steps involved in payroll automation.

Payroll Process Steps

The 5 crucial steps to process payroll are:

• Gather Employee Information

Gathering employee information is the first step of the payroll process. This is the foundational step because as accurate the information will be for the payroll process steps, fewer errors will occur.

Further, gather personal details like tax filing status, social security numbers and banking information for direct deposit of salary. Then the payroll process can become easy if the right details of employees with document management are there otherwise you can invite complications.

Additionally, bank details will be name, account type, account number and routing number. In order, to avoid possible errors, verify the accuracy of each employee’s social security number. Further collect full names, addresses and contact information. Overall this will help up keeping the information at one place only.

• Keep a Record Of Time And Attendance

After collecting all the essential information, the next step is tracking time and keeping an attendance record. Once you have the data regarding the number of days the employee was present, you can decide to pay them accordingly.

Further, use time and attendance management software to get relevant insights on working hours, leaves, shift schedules and attendance monitoring. Also, this method will come with less manual errors and more productivity.

• Calculations

Calculating gross pay is the next step in the list. This step involves determining the total earnings for each employee before deductions. Additionally, this includes regular wages, bounces, overtime pay and commissions.

Therefore, once you get time and attendance management software for your organisation you can get detailed calculations and insights. Now, after calculating the gross pay, it is time to check the payroll deduction.

• Payroll Deduction

After going through employee compensation, we will proceed with the payroll deduction. This includes mandatory withholding like state and local taxes and Medicare. Also, deduct employee contributions for health insurance premiums and retirement plans.

• Maintain Records

After the distribution of payments, we are now on the last step of the payroll process steps. Further, maintain accurate and organised payroll records. Also, it is essential for compliance with tax laws and future reference.

Overall, keeping these records can be complicated and might include errors that can be difficult to deal with later. But, with the help of time and attendance management software you can handle these tasks effectively and efficiently.

Conclusion

The guidelines in the payroll process in Qatar include employees who should get at least once a month on annual or monthly contracts. Also, payments are in Qatari Riyal (QAR) through the wage protection system (WPS). Further, maintain discipline and reduce errors with the top time and attendance management software. So, Schedule a demo today making the process to payroll easy.