New LWF Contribution Rates in West Bengal: Are You Prepared?

Have you heard about the latest updates to the Labour Welfare Fund (LWF) in West Bengal? Starting January 1, 2024, the Government of West Bengal has announced new contribution rates to enhance worker welfare across the state. If you’re an employer or employee in West Bengal, it’s important to understand these changes to ensure compliance and support the welfare initiatives. Let’s break it all down for you.

What is the Labour Welfare Fund (LWF)?

The Labour Welfare Fund (LWF) is a statutory contribution aimed at supporting the well-being of workers and their families. Managed by state authorities, the LWF provides financial aid and other assistance to individuals in need, helping to improve working conditions, ensure social security, and enhance living standards. Since the program varies across states, the benefits available in one region may not be applicable in another.

The funds collected through LWF are utilized for a range of welfare initiatives designed specifically for organized-sector workers, including:

- Financial Assistance: Providing monetary support to workers and their families during times of need.

- Skill Development: Funding training programs to help workers enhance their skills and boost career opportunities.

- Healthcare Support: Covering medical treatments for workers and their dependents.

- Housing Schemes: Developing housing solutions for workers to improve their living conditions.

- Retirement Benefits: Offering retirement funds and other forms of social security to ensure a stable post-work life.

By contributing to LWF, both employers and employees play a critical role in fostering a more secure and equitable work environment.

Labour Welfare Fund (LWF) in West Bengal

Let us understand the whole revision in detail.

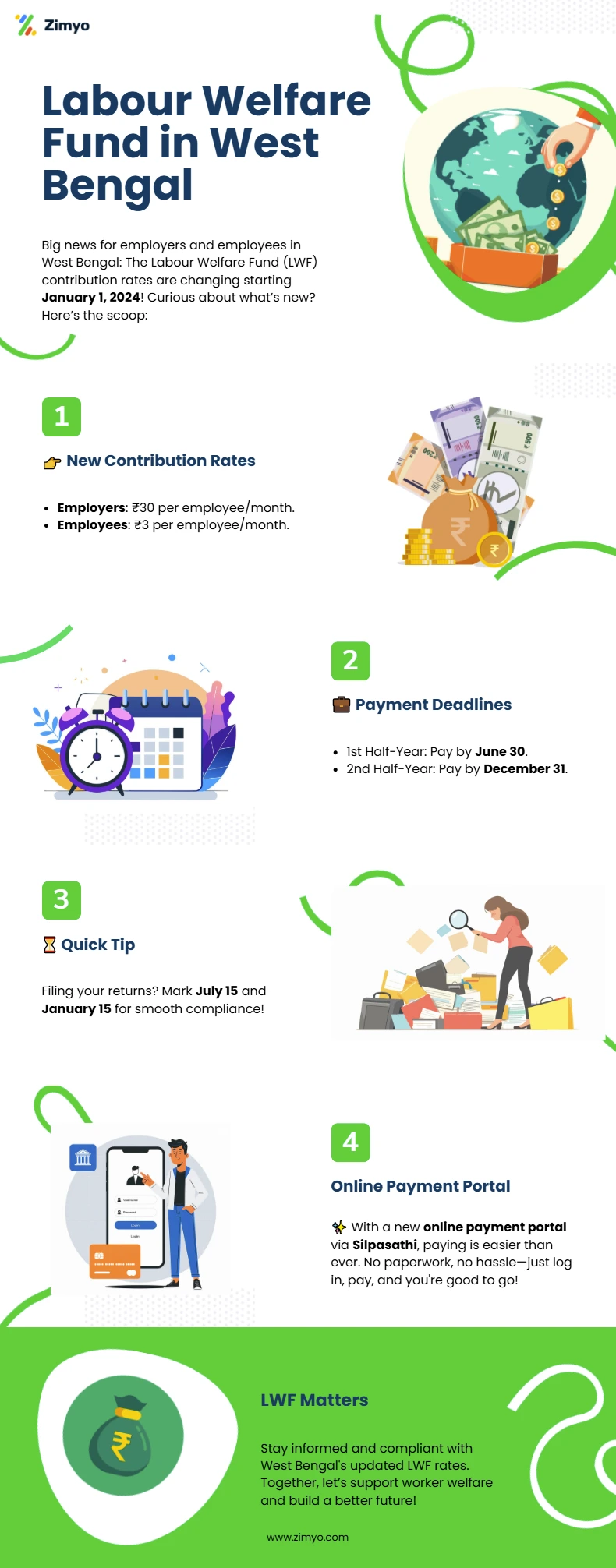

What are the New Contribution Rates?

The revised LWF contribution rates are designed to boost the welfare measures for workers. Here are the updated details:

- Employer Contribution: ₹30 per employee per month.

- Employee Contribution: ₹3 per employee per month.

These contributions ensure that both employers and employees play an active role in funding worker welfare programs.

When Do You Need to Pay?

Timely payments are crucial to avoid penalties. Contributions to the Labour Welfare Fund must be paid twice a year:

- First Cycle: By June 30 of each year.

- Second Cycle: By December 31 of each year.

For example, contributions for January to June must be cleared by the end of June, while payments for July to December should be completed by the end of December.

Simplified Online Payment Process

To make things easier, the government has introduced a convenient online payment method. Here’s how you can make your payments:

- Visit the Silpasathi Website.

- Click the “Apply Online” button located at the top-right section of the homepage.

- For registered users, log in using your credentials.

- After a successful payment, the system will generate a receipt for your records.

This online process reduces paperwork and encourages transparency in financial transactions.

What About Filing Returns?

Employers must also file LWF returns biannually. Filing returns ensures smooth administration and compliance. Here are the key dates to remember:

- July 15: File returns for the first half of the year.

- January 15: File returns for the second half of the year.

Failing to meet these deadlines can lead to unnecessary complications, so mark your calendars!

Why Does This Update Matter?

The revised contribution rates reflect the government’s commitment to improving worker welfare in West Bengal. Here are the key highlights:

- Enhanced Contributions: The increased rates ensure better funding for welfare initiatives.

- Transparency: The online payment portal simplifies processes and ensures accountability.

- Timely Compliance: Clearly defined deadlines help employers and employees stay on track with statutory compliances.

How Does It Impact Employers and Employees?

If you’re an employer, these changes mean you need to update your payroll systems to accommodate the revised contributions. Missing deadlines could result in penalties, so staying informed is crucial.

For employees, the increased contributions reflect a stronger commitment to your welfare. For example, these funds often support facilities like medical aid, housing, and education for workers and their families.

Practical Tips for Compliance

- Set Reminders: Mark the payment and return filing deadlines on your calendar.

- Utilize the Online Portal: Reduce the hassle of manual submissions by using the Silpasathi website.

- Keep Records: Save receipts and acknowledgment slips for future reference.

The Crux

The updated Labour Welfare Fund (LWF) contribution rates in West Bengal are a step forward in ensuring better welfare for workers. Whether you’re an employer or an employee, understanding these changes is essential. By complying with the new rates and deadlines, you contribute to a system that benefits everyone.

Stay informed, stay compliant, and support worker welfare. For more details, visit the official Labour Welfare Fund portal or contact the Labour Department today!