Initially, since the economy of the UAE and other GCC nations has been growing day by day due to the fast growth of businesses, the salary slip format in UAE and the salary certificate have become an essential document for both employees and employers. With a growing scale of recruitment and manpower growth in recent years, the salary slip has now become a mandatory document for each of the employees of all the UAE countries, including major business centers like Dubai and Abu Dhabi.

A payslip or salary slip is not a mere document; it is the legitimate evidence of compensation and earnings of employees. It provides an open record of wages, deductions, allowances, and net salary, which helps in financial planning, visa processing, loan sanction, and government subsidies.

This article goes in-depth about the significance of the UAE salary slip format, its elements, and how leveraging a strong HR software solution such as Zimyo can transform the payroll and salary slip management process for businesses throughout the UAE.

What is a Salary Slip ?

A salary slip, also known as a payslip, is an official document issued by an employer to an employee at the end of every pay period—typically monthly. It provides a detailed summary of the employee’s earnings, including basic salary, allowances (such as house rent, medical, and conveyance), bonuses, and any applicable deductions like provident fund contributions or loan repayments.

The salary slip also reflects the net salary or take-home pay after all deductions are made. In the UAE, receiving a salary slip is a standard legal requirement and serves as proof of income, making it essential for applying for loans, visas, and other financial services.

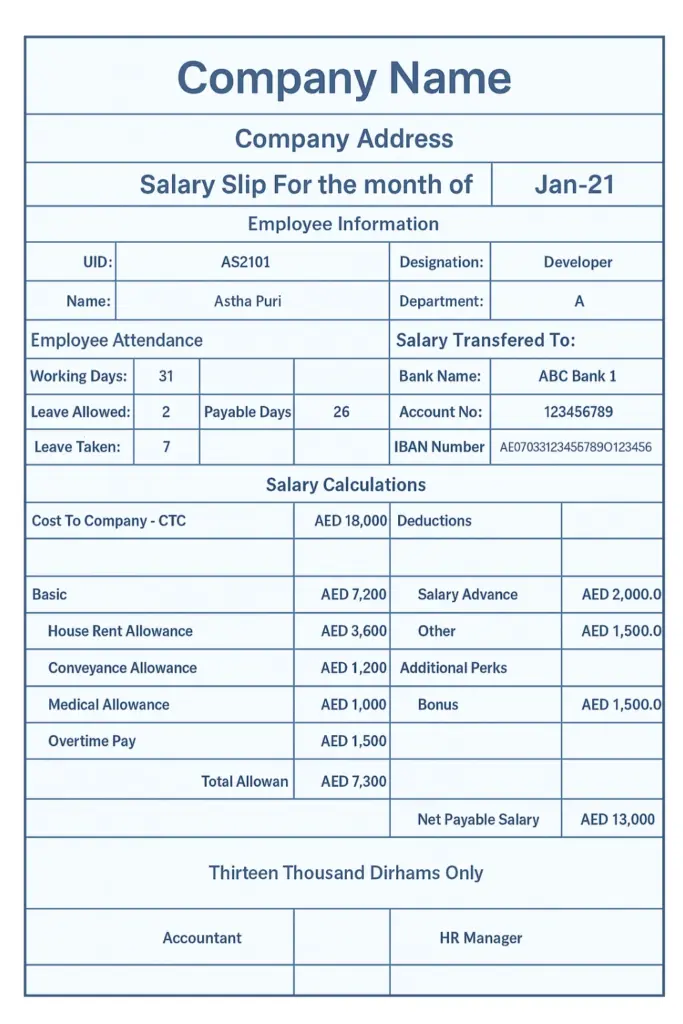

What is the Salary Slip Format UAE?

A salary slip format or a payslip format or salary slip form is an organized document issued by employers showing the employee’s income for a given pay cycle. In the UAE, be it startups or big firms, it’s compulsory by law and an important HR activity to issue a salary slip. It’s the right of the employees to get their salary slips, either hard copy or soft copy.

The salary slip enables employees to monitor their CTC (Cost to Company), basic salary, allowances like HRA (House Rent Allowance), conveyance, medical benefits, perks, and deductions. It is important to understand the meaning of compensation in this document, as it encompasses all wages an employee becomes eligible for according to the employment agreement.

Features of a Proper Salary Slip

A well-designed salary slip has multiple benefits to employees and employers alike:

1. Transparency & Employee Satisfaction

It enables the employees to conduct a swift Salary Check on a monthly basis so that they get the due amount. Honest payslips promote confidence and enhance employee morale.

2. Legal & Regulatory Compliance

In the UAE, every employee has Compliance to be provided with a salary slip irrespective of the working hours or the nature of the contract. This is done to obey labor laws and facilitate legal procedures like visa applications and loan sanctions.

3. Financial Documentation

Salary slips are accepted as authenticated evidence of income by financial institutions and government agencies. They are essential for obtaining government subsidies and welfare benefits. This deals. with overall document management also.

4. Payroll Accuracy

A precise payslip identifies imbalances early by itemizing gross salary, deductions, and net pay.

5. Streamlines Tax and Pension Procedures

Even though UAE does not have income tax, businesses can deduct such contributions as the 5% pension contribution in some instances, which must be properly recorded on the salary slip.

6. Facilitates HR & Payroll Automation

Creating uniform salary vouchers enhances HR choices, reduces human error, and hastens the processing of payroll.

Importance of Salary Slip in Dubai

In diverse business environments, where businesses operate across different sectors and employ a multicultural workforce, having a precise salary slip format in UAE is essential. The regulatory environment of Dubai demands that salary slips include clear attendance records, salary components, and follow the Wage Protection System (WPS) to ensure timely salary payments.

Abu Dhabi-Salary Slip

Abu Dhabi, being a mixture of enterprise sector and big companies, needs salary slips that accommodate more advanced compensation packages and benefits. The salary slip format in UAE for Abu Dhabi frequently incorporates individual allowances or privileges based on the emirate’s regulation to inform employees of a general compensation picture.

Important Elements of Salary Slip Format in UAE

To follow UAE laws and good practices, the salary slip must include these details.

- Employee ID or Payroll Number: This is a special number given to each employee by the company. It is unique to that person.

- Employer Details: Name of company and head office address.

- Employee Details: Full name, title, and department.

- Salary Month: Salary issue period.

- Attendance: Worked days, leaves, and Loss of Pay (LOP) days.

- Company Tax Code: If applicable, e.g., pension or other compulsory contributions.

- Gross Salary Breakdown:

- Basic Salary (usually about 60% of CTC)

- House Rent Allowance (HRA)

- Conveyance Allowance

- Medical Allowance

- Perks and Bonuses

- Deductions: Although there is no income tax in the UAE, whatever deductions are legally authorized should be included.

- Net Salary: Amount paid after making the deductions.

- Bank Account Details: Details of where the salary is credited, as per WPS.

- Payroll Processing Details: Payment date, payroll number, and signatory.

- Employer’s Stamp or Digital Signature: To authenticate.

The incorporation of all these components guarantees legibility and compliance with the regulations.

Streamline HR Tasks and Simplify UAE Salary Slip Process with Zimyo

How to Calculate Wage of Employees in Salary Slip Format UAE?

Wages forms an integral part of the salary slip format in the UAE. Furthermore, you need to mention the salary details of the employees which include:

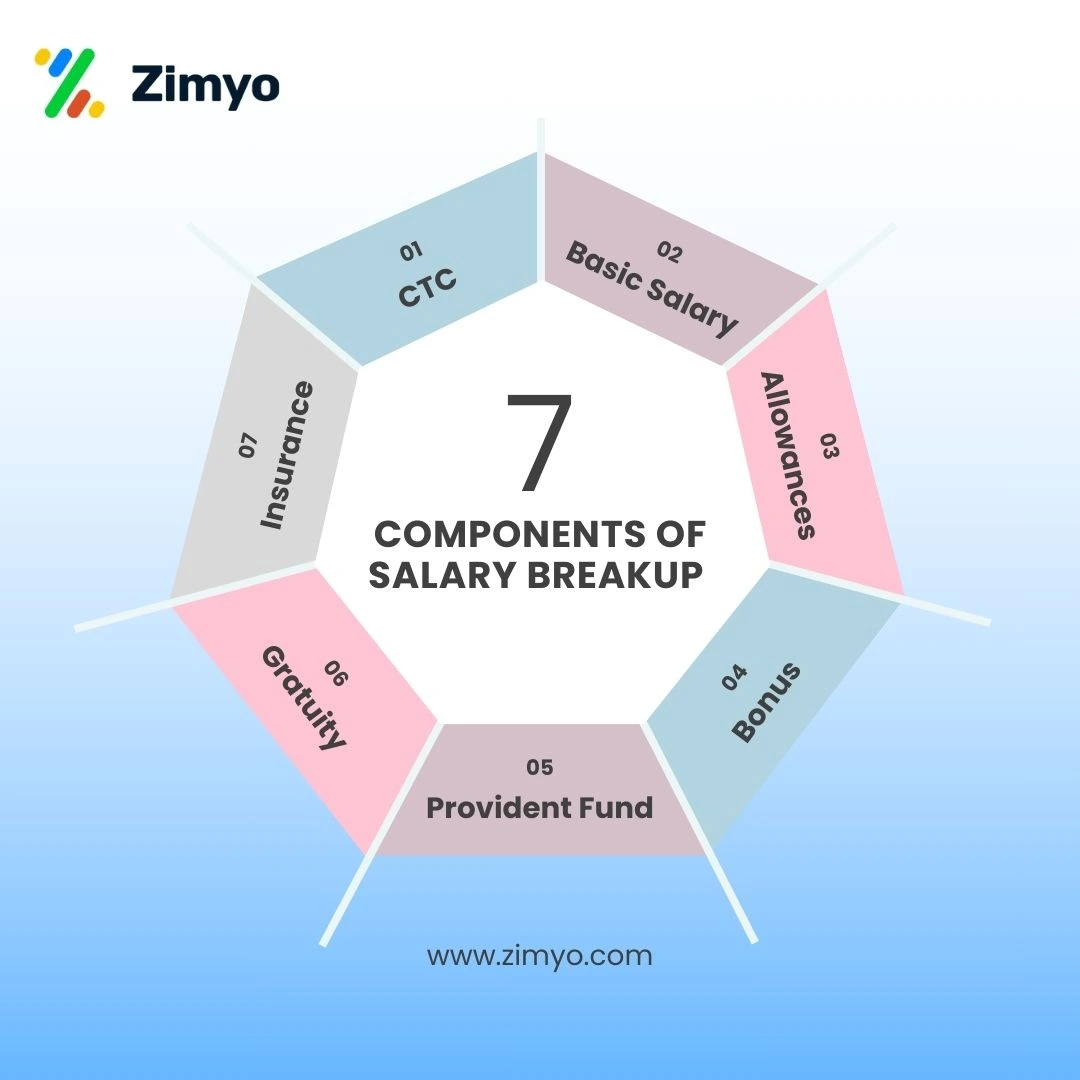

1. CTC (Cost to Company)

Cost to the company refers to the total cost incurred by the organization. It is the total salary package of an employee which includes basic salary, allowances and other benefits provided.

2. Basic Salary

Basic salary or in-hand salary refers to the amount an individual receives after all the deductions. This amount may differ from organization to organization and ranges around 60% of CTC.

3. HRA (House Rent Allowance)

This amount, included in the CTC, is paid for the accommodation of the employee in the employer’s city. Additonally, most companies provide HRA to employees hired from abroad.

4. Conveyance Allowance

The employer pays this amount for employees’ commute from home to work and back. Therefore, this amount varies from organization to organization depending upon their policies.

5. Medical Allowance

Employers pay this amount to their employees to cover medical expenses. Although, some organizations provide the full amount for the expenses incurred while some provide a fixed amount. Also in some case medical certificate is required.

6. Perks

This section of an employee’s salary slip is left vacant until extra perks or bonuses are provided. Since companies generally provide bonuses on various festivals. It may vary from organization to organization.

7. Net Salary

In most of the salary slip format issued in UAE, the net salary has a specified formula. So, if you as an employer are creating salary slips you must use the formula.

Calculation:

⁂ Net salary = Gross Salary – Deductions

What is the Salary Certificate format in UAE?

Whereas salary slips are issued monthly, salary certificates are formal certificates issued at request confirming an employee’s employment status and salary, usually required for visa processing or for loan processing.

A salary certificate typically includes:

- Date of issue

- Full name and gender of employee

- Position

- Date of joining

- Net and total remuneration

- Reimbursements and benefits (if any)

- Official signature, title, contact information, and company stamp from the HR division

As opposed to salary slips, salary certificates do not necessarily outline all components of the salary but rather official verification of employment and salary amounts

Difference Between Salary Slip and Salary Certificate

Factor | Salary Slip | Salary Certificate |

Purpose | Monthly proof of salary | Official proof of employment and income |

Frequency | Issued monthly | Issued on request |

Salary Break-up | Elaborate break-up of income and deductions | Typically reflects gross or net figure only |

Used for | Loan requests, confirmation of salary | Visa requests, bank loans, proof of employment |

Format | Comprehensive tabular format | Official letter bearing employer’s seal and signature |

Details Included | Employee attendance, leave deductions, overtime | Employment duration, designation, total compensation |

Legal Status | Payroll document for record-keeping | Official document used for verification purposes |

Validity Period | Valid only for the specific salary period | Can cover multiple months or years of employment |

Issuer | HR or Payroll department | Usually HR Manager or authorized signatory |

Confidentiality | Typically confidential between employee and employer | May be shared externally for verification |

Customizability | Standardized monthly format | Can be customized for different official uses |

Tax Information | Usually includes tax and deduction details (where applicable) | Rarely includes detailed tax or deduction info |

Verification | Internal verification by employer and employee | External verification by third parties like banks or immigration |

Format Medium | Physical or electronic payslip | Usually a formal letter, sometimes printed on company letterhead |

Additional Components | May include bonus, incentives, reimbursements | Generally focuses on employment and salary confirmation |

Essential Features of Zimyo for Salary Slip Management

Zimyo is a cutting-edge HR and payroll solution for UAE businesses. Its features for salary slip management are:

- Automated Payslip Generation: Pre-formatted templates that are specifically geared for UAE payroll requirements.

- WPS Compliance: Provides for all salaries to be paid via the Wage Protection System.

- Dynamic Salary Breakdowns: Easy display of all elements—basic, allowances, deductions.

- CTC Insights: Offers an in-depth Cost to Company view.

- Attendance Integration: Automatically integrates attendance and LOP data.

- Digital Payslip Delivery: Payslips are delivered to employees by email or self-service portals.

- Multi-location Support: Manages Dubai, Abu Dhabi, and other emirates’ differences.

- Customizable Templates: Logos, brand colors, and custom fields can be added by companies.

- Salary Calculator: In-built functionality for simulating salary calculator changes.

- Bulk Payslip Generation: Large companies can generate payslips for hundreds or thousands of employees at one time.

- Secure and Role-Based Access: Safeguards confidential payroll data.

Enterprise-Driven Payroll Solution

Large enterprises with geographically dispersed employees in various emirates will benefit from Zimyo’s enterprise-driven architecture:

- Locality-based payroll rules

- Salary configuration by department

- Comprehensive reporting on gross salary breakup, wages, deductions, and YTD compensation

- Smooth integration with HRIS and ERP solutions

- Scalability for start-ups expanding into multinational entities

This maintains the payroll processes smooth, compliant, and scalable.

Why Choose Zimyo?

Selecting a proper payroll and HR software is key. Zimyo excels in: Its deep knowledge of UAE labor laws and regulations. User-friendly interface for minimal training. Automation that minimizes human error in creating salary slips and payroll. Cost-effectiveness compared to manual processing or generic software. Empowerment of employees through self-service portals and salary calculators. Facilitating businesses of every size—from startups to large corporations. Regular updates in tandem with changing UAE payroll and labor law.

Conclusion of Salary Slip Format

The UAE salary slip format is an important document for both employees and employers. It clearly shows how much money an employee earns, how much is taken away, and all the details about their pay. Overall this helps employees quickly check their salary and helps others to have a correct knowledge about.

In countries like Dubai and Abu Dhabi, where business is growing fast, it’s important for companies to make sure their payslips are accurate and clear. Further Using modern HR tools like Zimyo can help with this. These tools create payslips that follow the rules of the Wage Protection System and local laws.

By using automation with Zimyo, you can make payroll easier, calculate salaries without problems, and salary slips. Schedule a demo to helps your employees feel secure and supports your business in long run.

Easy Payroll Management in UAE

FAQ's (Frequently Asked Questions)

It can be asked from HR or employer; most businesses offer it monthly with the salary payment. It is generally dispatched via email or company websites for records and reference.

It contains the name, designation, date of joining, and complete breakdown of salary on company letterhead. It should be signed and stamped by authorized officials for official use.

You can have it from your HR section or download a UAE-approved template from the net. It should contain company name, employee information, salary breakdown, and deductions.

Payslips are not compulsorily required by law in the UAE, but they are given by most employers on a monthly basis. They are required for transparency and necessary for bank, loan, or visa applications.

Payslips, salary certificates, or bank statements displaying salary deposits are acceptable. They are necessary for financial, immigration, or legal reasons in the UAE.

It is a comprehensive monthly report by UAE employers displaying gross salary, deductions, and net salary.

Utilized for financial validation, it represents official salary transactions.

It is a comprehensive monthly report by UAE employers displaying gross salary, deductions, and net salary.

Utilized for financial validation, it represents official salary transactions.

Only to the employee by the employer.It can be used for banks, visa processing, or for government-related submissions.

What People Think About Zimyo