Top Best Payroll Software in Thailand

Handling payroll is a key responsibility for any business owner these days. It involves more than just calculating salaries. Payroll management encompasses tax compliance, benefits administration,over time plans and accurate record-keeping. In Thailand, where labor laws and tax regulations are specific and often complex, businesses need reliable tools to ensure smooth payroll operations.

This is where payroll software in Thailand plays a significant role. Whether you run a startup, a mid-sized company, or a large enterprise, payroll software is essential to manage these tasks efficiently. Among the many options available, Zimyo stands out as the best payroll solution, offering businesses an easy and high-tech system to manage their payroll needs effectively.

In this comprehensive blog, we will explore:

- What payroll is and why does it Matters?

- Top Payroll Solutions in Thailand

- An in-depth comparison of other top payroll solutions in Thailand.

- Zimyo

- FlowAccount

- TTC Payroll

- Asteriolion Payroll

- TopSource Worldwide

- How to choose the right Payroll software fo your Bussiness

- Why Zimyo is the best choice among others.

- Frequently Asked Questions

What is Payroll, and Why Does It Matter?

Payroll refers to the process of compensating employees for their work, including salary calculations, tax deductions, benefits management, and compliance with local labor laws. It also involves generating payslips, filing taxes, and ensuring accurate payments to employees.

In Thailand, payroll systems must adhere to specific tax regulations, social security requirements, and labor laws. Any errors in payroll processing can lead to penalties, legal issues, or employee dissatisfaction.

By using payroll software in Thailand, businesses can:

- Automate salary calculations and deductions.

- Ensure compliance with Thai tax laws.

- Save time by reducing manual processes.

- Improve data accuracy and reduce errors.

- Enrich employee satisfaction through timely payments.

Top Payroll Solutions in Thailand

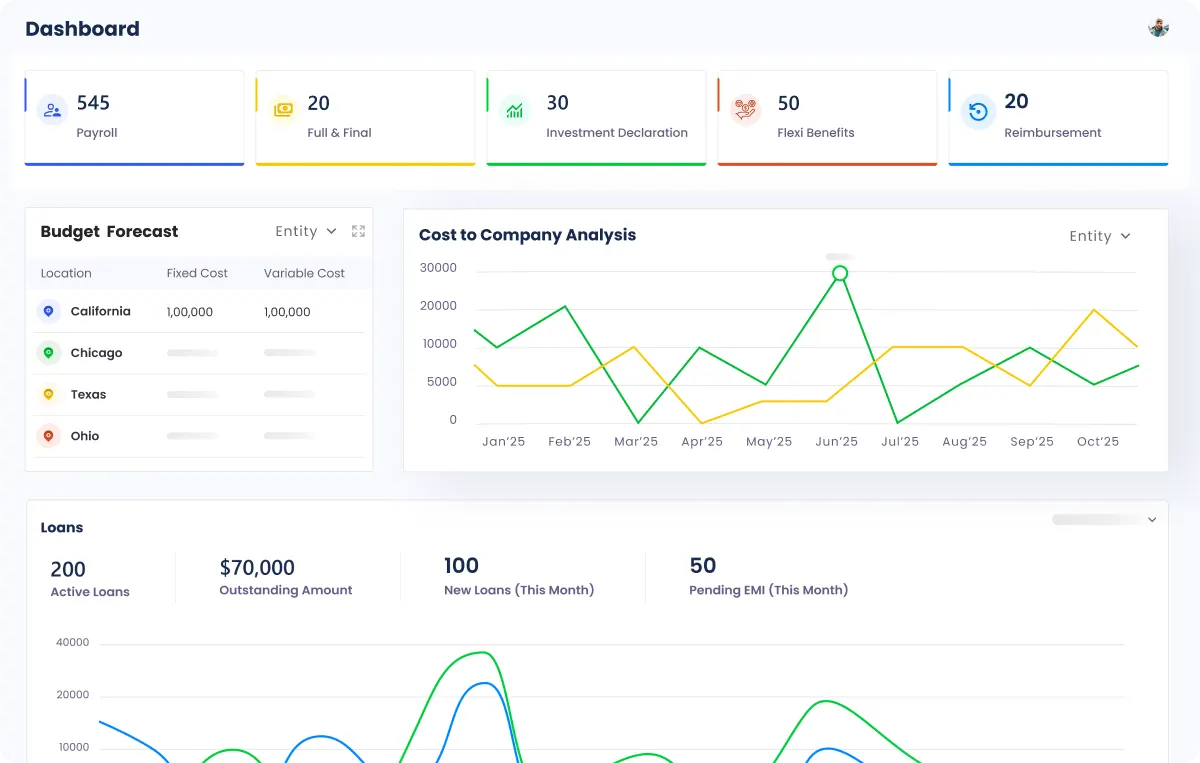

1. Zimyo – The Leader in Payroll Software

Zimyo revolutionizes payroll management by providing a robust, easy-to-use platform for Thai businesses. Whether you’re a small startup or a large enterprise, Zimyo HRMS ensures payroll processes are smooth and efficient.

Key Features of Zimyo Payroll Software

- Automated Salary Calculations

Zimyo automates complex salary computations, including overtime, bonuses, and deductions, encashing leaves ensuring accurate results every time. - Compliance with Thai Labor Laws

Zimyo aligns with local tax regulations and social security contributions, keeping your business compliant. - Real-Time Attendance Tracking

Integrated attendance systems allow payroll to be processed based on real-time attendance data, reducing errors and manual adjustments. - Customised Reports

Generate detailed payroll reports for audits, tax filing, and decision-making with just a few clicks. - Employee Self-Service Portal

Employees can access payslips, tax documents, and leave balances through a dedicated self-service portal, saving HR teams valuable time. - Secure Data Storage

With advanced encryption, Zimyo ensures the confidentiality and security of your payroll data. - Multi-Currency and Multi-Language Support

Perfect for businesses with diverse teams or global operations, Zimyo supports multiple currencies and languages. - Integration with HR and Accounting Systems

Effortlessly integrates with your existing HR and accounting tools for smooth data sharing and processing. - Expense Management Integration

Manage travel, petty cash, and reimbursements directly through Zimyo’s payroll module. - Tax Filing Assistance

Automatically generates and files Thai tax forms, saving you time and ensuring accuracy.

Benefits

- Accuracy and Reliability

Automating payroll minimizes human errors, ensuring employees are paid accurately and on time. - Compliance with Thai Laws

Stay updated with local labor laws and regulations to avoid penalties and legal complications. - Cost-Effective Solution

Zimyo reduces administrative costs by automating repetitive tasks. - Employee Satisfaction

Ensuring prompt and precise payroll processing fosters trust and boosts employee morale. - Scalability

Whether you’re a startup or an established business, Zimyo’s payroll solution grows with your organization.

Zimyo is the perfect solution for businesses looking to improve their payroll processes and ensure employee satisfaction.

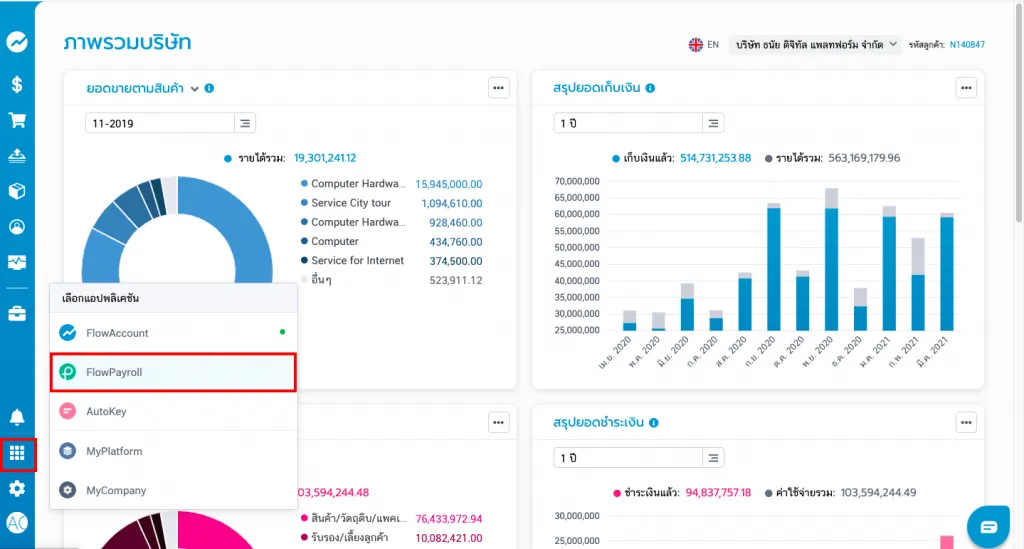

2. FlowAccount

FlowAccount is a popular choice for small businesses that require payroll management combined with accounting functionalities. It is simple to use and caters specifically to startups and SMEs.

Key Features:

- Simplified salary calculations for small businesses.

- Built-in tax form generation for Thai compliance.

- Expense and invoice management integrated with payroll.

- Mobile app support for payroll management on the go.

- Employee attendance tracking linked with payroll.

FlowAccount’s user-friendly interface makes it an attractive option for businesses with minimal HR resources.

3. TTC Payroll

TTC Payroll specializes in providing outsourced payroll services. It’s an excellent choice for businesses that prefer to delegate payroll operations to a trusted third party.

Key Features:

- Comprehensive payroll processing and administration.

- Monthly reporting and analytics for financial planning.

- Compliance with Thai tax laws and social security contributions.

- Direct deposit for salaries and tax payments.

- 24/7 customer support for payroll queries.

TTC Payroll is suitable for businesses that need full-service payroll support without managing it in-house.

4. Asterlion Payroll

Asterlion offers payroll services with an emphasis on customization and compliance, making it suitable for medium to large enterprises.

Key Features:

- Automated payroll processing with local tax compliance.

- Employee lifecycle management from onboarding to exit.

- Integration with HR and accounting systems.

- Detailed reporting and analytics for payroll insights.

- Multi-currency payroll management for international teams.

- Secure cloud-based data storage.

Asterlion stands out for its flexibility in catering to complex payroll requirements, especially for growing enterprises.

5. TopSource Worldwide

TopSource Worldwide focuses on providing global payroll solutions, making it ideal for multinational companies operating in Thailand.

Key Features:

- Payroll management across multiple countries with compliance.

- Integration with ERP and HR systems for flawless data sharing.

- Customised workflows for payroll approval and processing.

- Employee benefits and tax management adapted to local laws.

- Real-time payroll analytics for better financial control.

- Multi-currency and multi-language support for global operations.

TopSource is particularly beneficial for businesses that require payroll solutions beyond Thailand’s borders.

How to Choose the Right Payroll Software for Your Business

- Understand Your Needs: Evaluate the size of your business, the complexity of payroll processes, and your budget.

- Focus on Compliance: Choose software that adheres to Thai labor laws and tax regulations.

- Look for Automation: Automation reduces errors and saves time, so prioritize solutions with high-tech features.

- Employee Self-Service Options: Ensure the software includes a self-service portal for employee convenience.

- Integration Capabilities: The software should integrate seamlessly with your existing HR and accounting systems.

Why Zimyo is the Best Choice among Others

Zimyo’s commitment to providing high-tech and easy payroll solutions makes it the preferred choice for businesses in Thailand. Its ability to handle payroll with precision and compliance ensures peace of mind for business owners and HR professionals alike.

Choose Zimyo and redefine how you manage payroll in Thailand. Experience a hassle-free, efficient, and reliable payroll system designed to align with your business needs.

FAQs[Frequently Asked Questions]

What is payroll software in Thailand?

Payroll software automates salary calculations, tax deductions, and compliance with labor laws, saving businesses time and reducing errors.

Why is payroll software important for Thai businesses?

Payroll software ensures accurate salary processing, compliance with Thai regulations, and improved employee satisfaction.

How does Zimyo simplify payroll management?

Zimyo automates payroll tasks, aligns with Thai labor laws, and provides secure data management, making it a reliable choice for businesses.

Can Zimyo handle compliance with Thai labor laws?

Yes, Zimyo is designed to comply with Thai labor laws and tax regulations, ensuring smooth payroll operations.

Why is Zimyo the best payroll software in Thailand?

Zimyo offers customized features, high-tech automation, and secure data management, making it the leading payroll solution for Thai businesses.