The way organizations manage their workforces and HRM and payroll operations is changing due to the ever-changing business landscape and the convergence of technology and workforce management. Payroll solutions that are accurate, timely, and efficient are becoming increasingly important as businesses grow in Saudi Arabia.

When payroll time arrives, do you get sick of getting lost in a sea of paperwork?

Do you often find yourself putting in endless hours on time-consuming computations and compliance audits rather than concentrating on important HR projects?

Numerous difficulties arise with manual payroll processing, such as tedious data entry, calculation errors, and a higher chance of non-compliance. As a result, payments are delayed, and the effectiveness of the finance and HR departments is decreased.

Payroll mistakes can significantly affect any organization’s bottom line. These challenges underscore the requirement for efficient payroll software that enhances accuracy and compliance while automating procedures.

The best payroll software has several features, such as e-filing, employee portals, accurate computations, effective time management, and basic automation. These products greatly increase overall productivity and compliance adherence in addition to reducing your administrative strain. As a result, it turns out to be a wise investment that allows businesses to concentrate on their main goals while maintaining accuracy in payroll processing.

But there are a ton of possibilities on the market, all of them claiming to be the greatest and most appropriate solution.

So how do you pick your company’s best payroll software?

Do not worry; we will walk you through the process of selecting the best payroll software in this article by highlighting important features, advantages, disadvantages, costs, and factors to take into account while selecting top options.

As a result, you’ll be better equipped to pick a choice that fits the particular requirements and goals of your organization, turning payroll management from a difficult task into a strategic advantage.

How do you Select the Right Payroll Software?

You now require software since you have realized that you need help with processing payroll manually.

So, how to choose the one that would work best for your organization?

Don’t worry, we have compiled all the factors you can think about to decide wisely.

The right payroll software may help any size business, from start-ups to established ones. Streamlining payroll procedures and guaranteeing tax compliance can save time and money.

1. Is it Scalable enough?

As your organization grows over time, your payroll requirements will also get more complicated. For this reason, you require software that can expand with your organization.

Which software, then, is scalable enough to meet your needs for expansion?

You can look for characteristics like unlimited employee support, customizable price plans, and the capacity to manage intricate payroll circumstances like various pay structures, benefits, and tax laws.

2. Is it capable of handling Compliances?

Governments adjust compliance requirements in response to the simultaneous occurrence of inflation and economic growth, therefore you must be informed about these changes. Using automated payroll software instead of human payroll processing can assist prevent legal problems and financial losses due to noncompliance with regulations. Select payroll software that can easily incorporate updates to compliance into its computations and reporting.

3. Can it Integrate seamlessly with your other Software?

Your software must work well with other programs for it to automate all of your payroll procedures. Complying with HRMS, recruiting, and other software requirements promptly can increase the payroll and onboarding processes each month.

Integration features minimize human data entry and guarantee data consistency throughout the company by enabling data synchronization and automation of payroll procedures across several systems.

4. What is the cost of the software?

Payroll software can be quite beneficial, as you have seen, but it is not free. This can be a wise investment because it saves you a lot of time and keeps you compliant, but it shouldn’t be entirely outside of your budget.

Thus, determine your budget first (you might choose a range), and then search for software that offers the functionality you require at the same price. Choose by comparing all of the software.

5. How safe will your information be?

Payroll data includes sensitive financial and personal information, therefore it goes without saying that you need software that secures all of your data. Seek payroll software with features like role-based access controls, data encryption, and frequent security audits to safeguard private employee data and guarantee adherence to privacy laws.

6. What is the state of the customer service?

The job doesn’t finish here just because you invested in payroll; what if you run into problems while using it?

You therefore require ongoing help and encouragement to continue working effectively.

Choose a service provider that offers helpful customer assistance—by phone, email, or live chat, if possible. Think about whether they provide resources, training, and continuing support to help you get the most out of the product.

7. What are the reviews?

It is crucial to read reviews before making any purchases, especially those of software that can be pricey, especially on reliable websites. For reviews, go for sites like G2, Capterra, Softwaresuggest, etc., where organizations offer their real user experiences and you can trust them.

To learn about the opinions and experiences of the many users on the platform, you can also get in contact with them. After you’ve decided on the features you want, read the reviews.

List of Best Payroll Software in Saudi Arabia

With so many alternatives available, visiting each payroll website and examining their capabilities can become an overwhelming task for you. Don’t worry; we’ve put up the list so you can choose wisely.

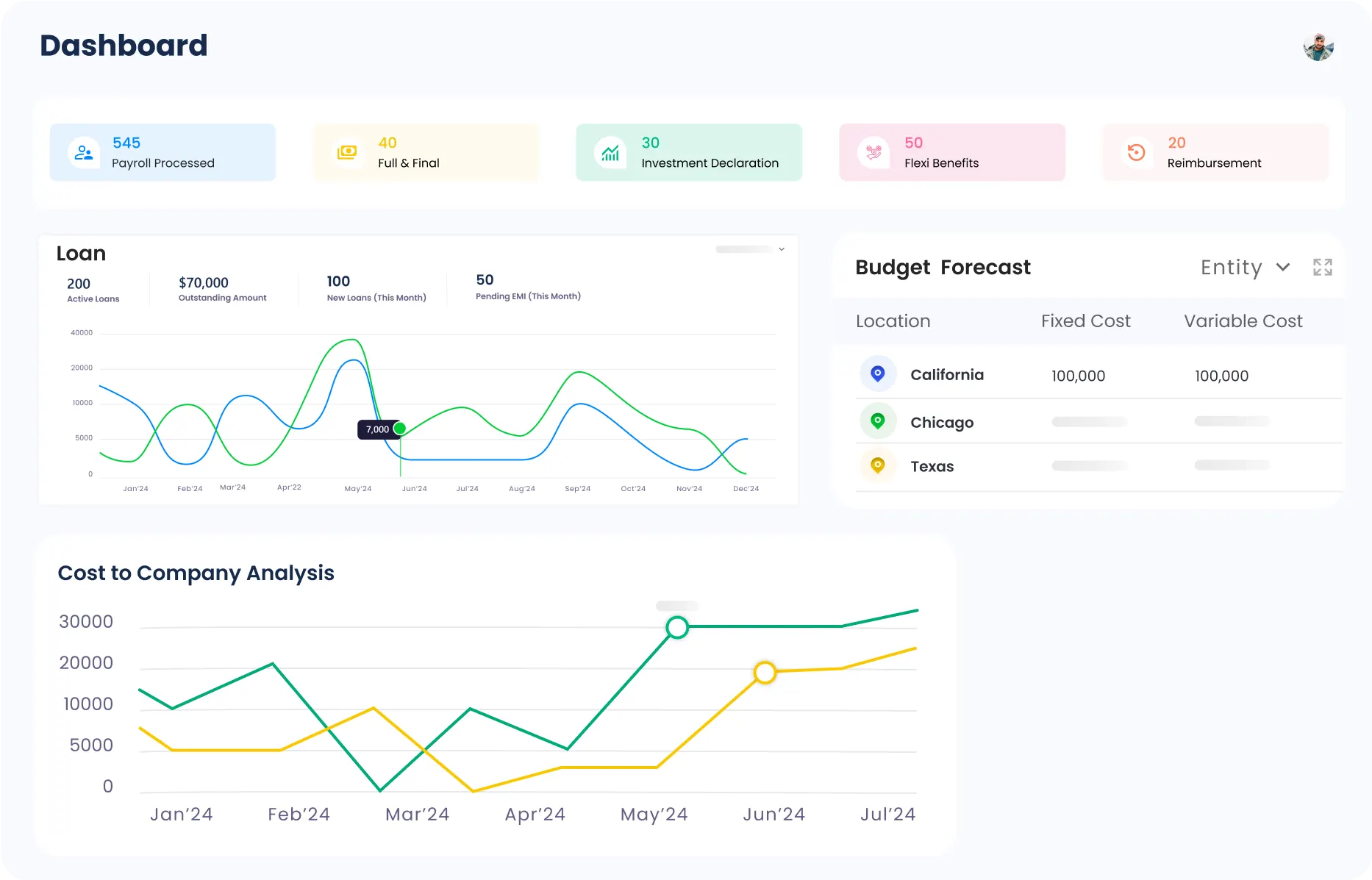

Zimyo is a leading global provider of complete HRMS and payroll solutions that are designed to satisfy the various needs of your organization in Saudi Arabia and the GCC region. It provides a comprehensive suite of solutions ranging from hiring to offboarding and all points in between.

These solutions include HR and payroll management, application tracking systems (ATS), performance management, time and attendance monitoring, and employee engagement tools. You can tailor your experience to your organization’s needs by choosing from over 48 modules. This cloud-based software ensures smooth operations and increased productivity by optimizing every facet of the employee lifecycle.

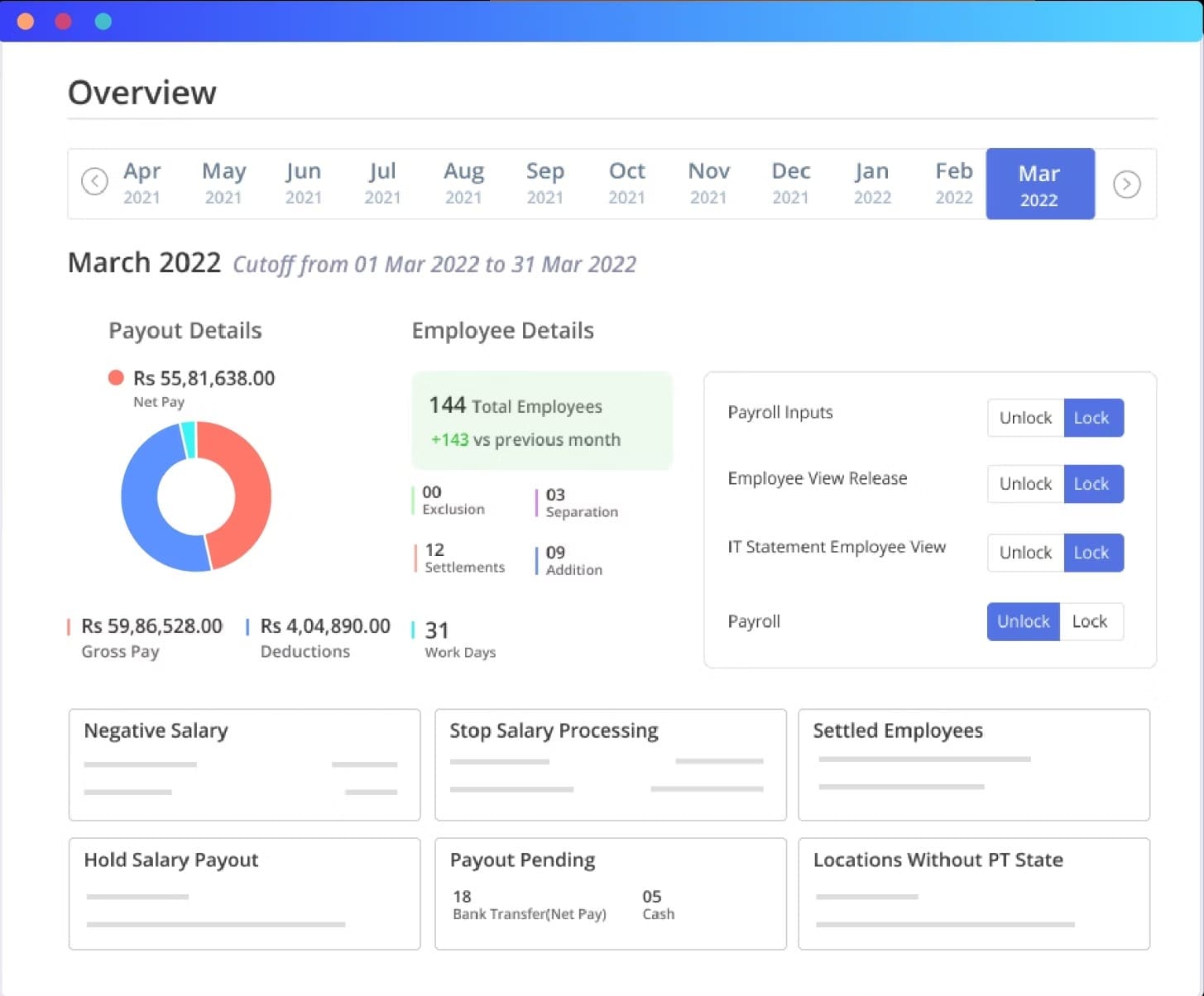

With only five clicks to execute payroll, the user-friendly interface of Zimyo’s payroll software ensures compliance with GCC rules and eliminates manual errors while providing optimum accuracy. It manages all intricate payroll issues and is available with a variety of payment options.

Established in 2018, Zimyo has emerged as the most reliable platform in a short amount of time, as industry analysts like G2 have acknowledged it as the best in the payroll area. It will empower your organization by streamlining your payroll procedures, regardless of your size.

Key Features

- Automated salary computation

- Configurable Salary Structure

- Multicurrency Payroll Processing

- Employee Self Service

- Automated payslips

- TDS calculation

- Expense Management

- Overtime calculation

- Customized Reports

- Mobile Accessibility

- Data Security

- Compliance with GCC laws and regulations

- Forms Repository

- Arrears Calculation

- Loans and Advances

- Tax Calculator

- Full and Final Settlement

- Employee Benefit Management

- Payout

Pricing

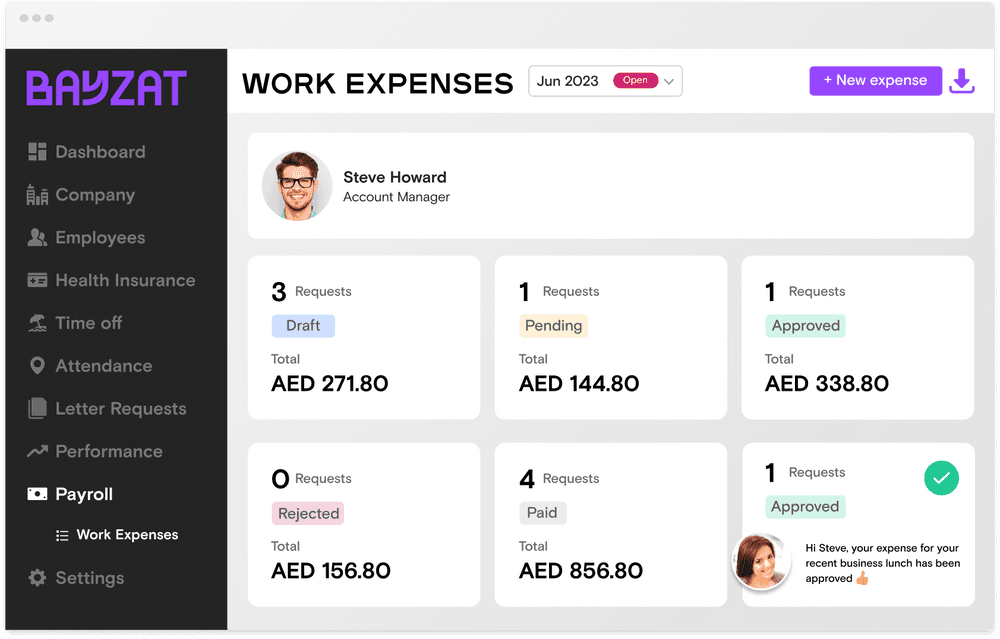

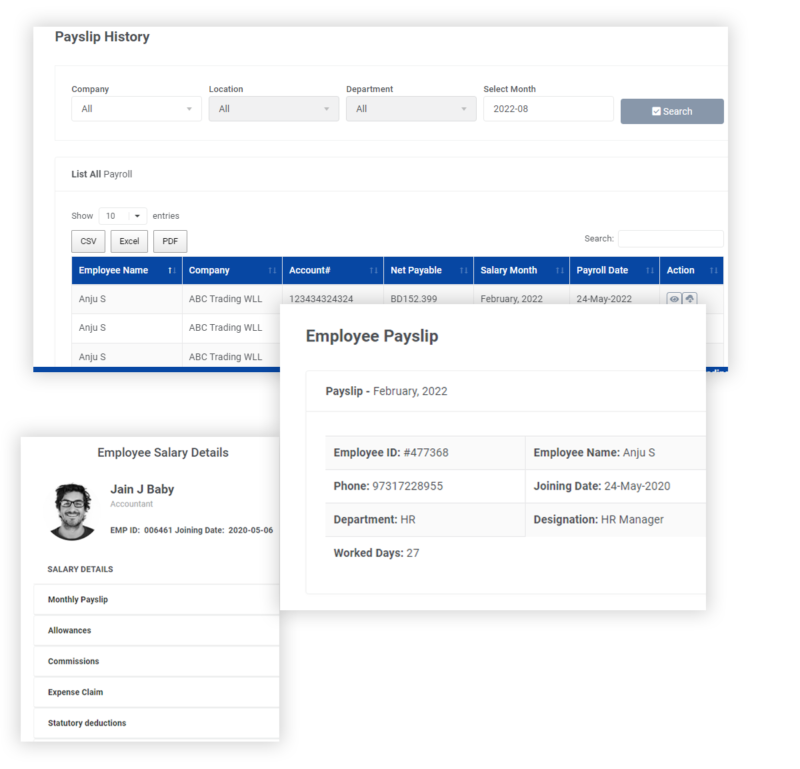

In Saudi Arabia, Bayzat is one of the most well-known providers of payroll software. The payroll software is developed domestically in Saudi Arabia to meet the demands of Middle Eastern business owners.

This payroll solution saves you time and effort by assisting in the elimination of calculation errors in salary payout. Moreover, HR can obtain pay records from the platform at any time and from any location.

Key Features

- Payroll processing

- Work expense management

- Auto-generate payslips

- Manage allowances and overlaps

- Employee Benefit Management

- Multiple languages

Pricing

To know the pricing of Bayzat payroll software connect with its sales team.

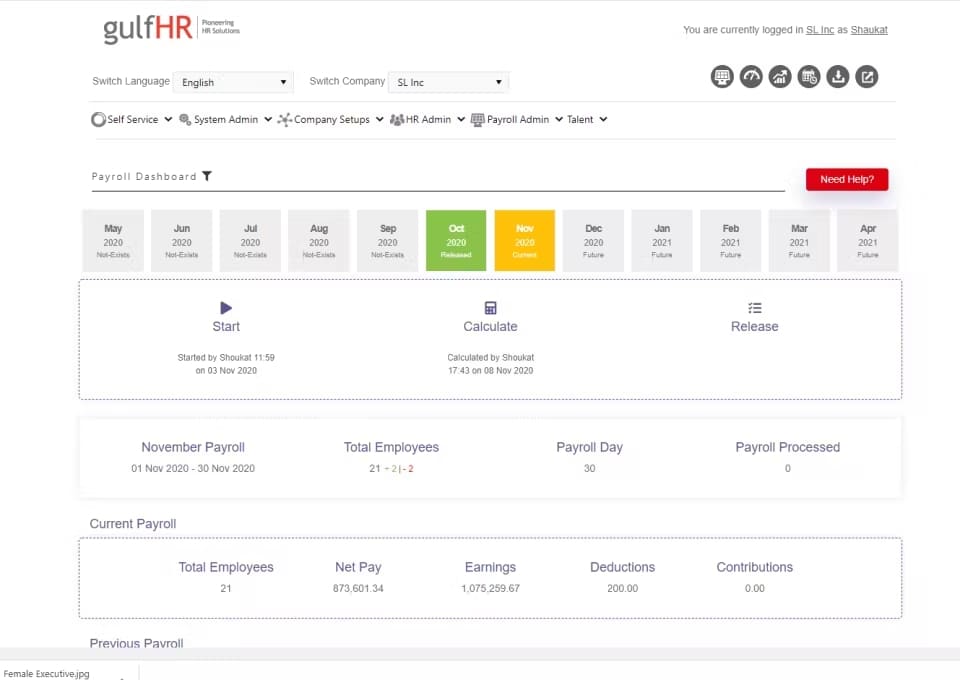

GulfHR is a payroll system designed specifically for Middle Eastern nations. The payroll system makes Middle Eastern firms’ complicated legal requirements and compliances easier to understand.

With an Arabic language interface, Gulf HR also gives its clients the ability to tailor payroll processing to the requirements of their respective organizations. The platform is trustworthy because it has been serving Middle Eastern business owners’ needs for over 20 years.

Key Features

- Generate payroll reports

- Salary advance payment

- Generate payslips

- Payroll processing

- Compliance with the laws

- Multiple languages

Pricing

To know the pricing of GulfHR payroll software contact their sales team.

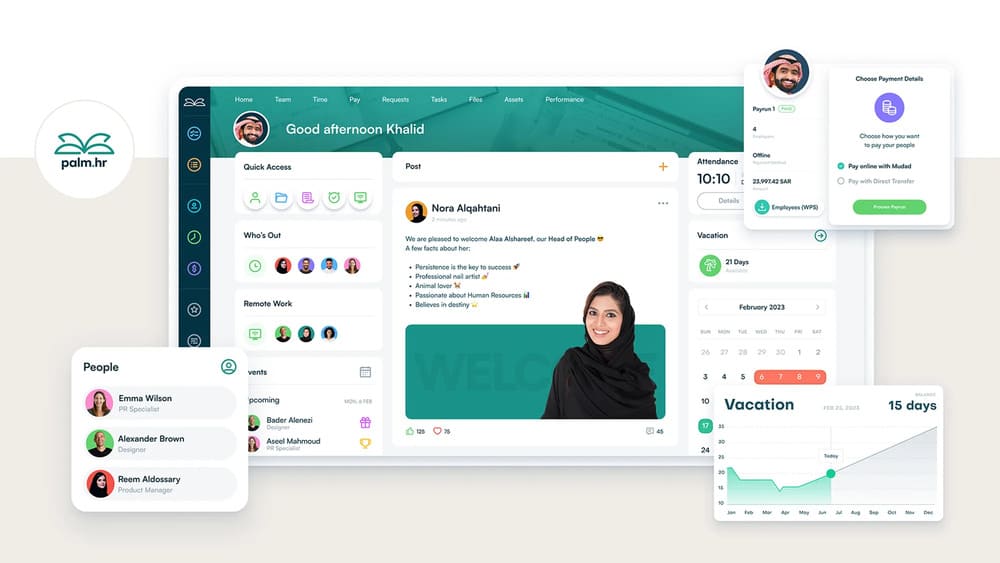

PalmHR is a cloud-based payroll solution called assists businesses in completing payroll without errors. Human resource managers can handle all the challenges associated with payroll processing in Saudi Arabia thanks to payroll software.

The PalmHR payroll software guarantees a seamless payroll process with all the additions and deductions in the salary disbursement, including taxes and complicated compliances.

Key Features

- Payroll Processing

- Compliant with labor laws

- Employee Self Service

- Generate Payslips

- Data Security

- Tax management

Pricing

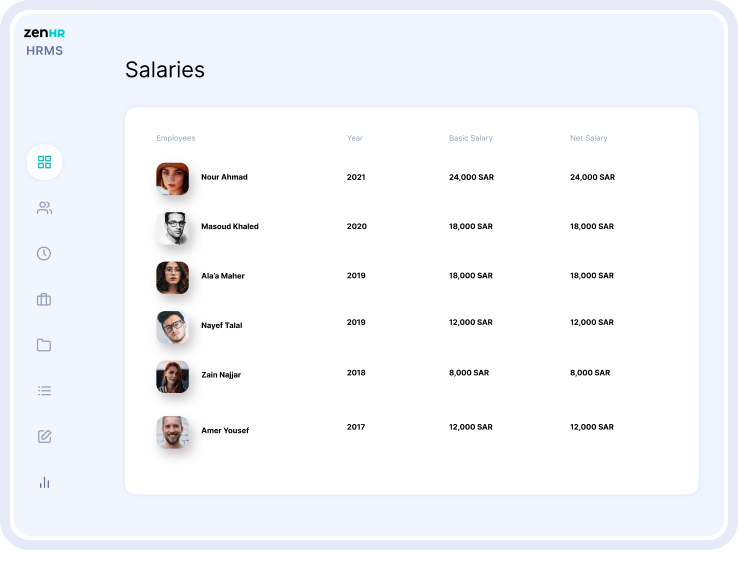

In the market for HR and payroll solutions, ZenHR is a well-known brand. In the Middle East areas, the platform provides cloud-based payroll solutions. Many advanced features are available in payroll software to assist businesses in automating payroll procedures.

The platform completely supports the MENA region’s legislation and compliances. Moreover, this payroll software has numerous bilingual user interfaces, mobile apps, and a host of additional functions.

Key Features

- Payroll management

- Generate Payroll Reports

- Compliant with Labor laws

- Data security

- Overtime Requests

- Loan and advances

Pricing

To know the pricing of ZenHR payroll software request for a quote from their sales team.

With the use of cloud-based payroll software called Artify 360, businesses can process payroll without errors. Payroll software can be integrated with leave and attendance software by managers to ensure that employees receive correct and timely compensation.

To protect sensitive data, including financial and personal information, this cloud-based payroll software in Saudi Arabia adheres closely to security regulations. Furthermore, the features can be tailored to your organization’s size and policies.

Key Features

- Generate Payslips

- Customize Payroll Reports

- Data security

- Single Click Payroll Approval

- Compliance with the laws

- Payroll Integrations

Pricing

GreytHR provides payroll software solutions for small and large businesses in the Saudi Arabia and GCC regions. With the use of guided payroll processing checklists, they offer 100% statutory compliance, assisting their clients in paying salaries on schedule.

HR experts can add salary components and modify salary structures on the platform based on the demands of the organization. Additionally, payroll reports can be generated by the customers.

Key Features

- Payroll processing

- Customize payslips

- Compliant with the labor laws

- Generate Payroll reports

- Add unlimited salary components

- Payroll Integrations

Pricing

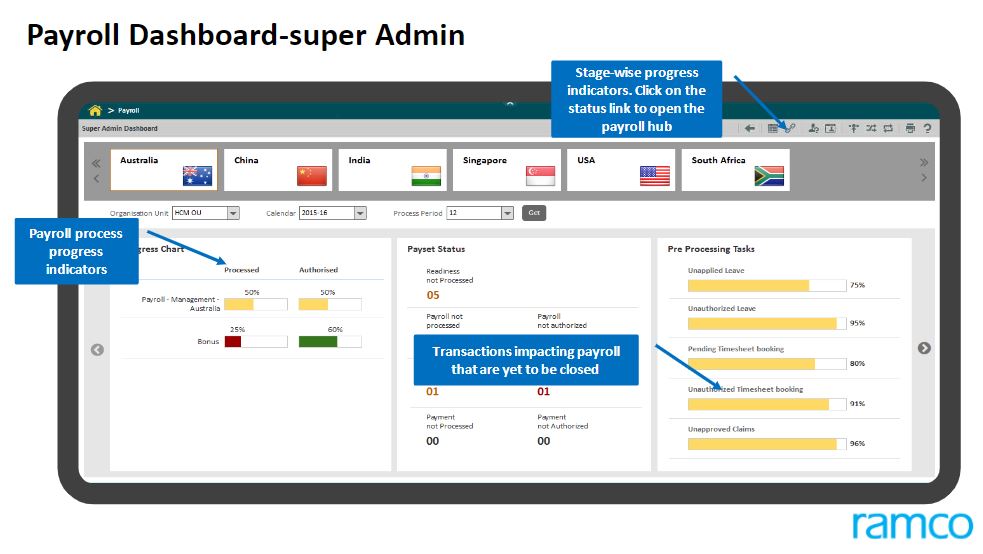

Ramco is a cloud-based payroll software that assists businesses in overcoming the challenge of processing payroll. The software provides an error-free compensation estimate for each employee, covering everything from tax to regulatory changes.

Additionally, the payroll software offers bilingual help in Arabic and English. To compute precise compensation, the program is additionally coupled with time and attendance and costs modules.

Key Features

- Generate Payslip

- Configurable Salary Structure

- Compliant with Local Law

- Employee Self Service

- Customized Leave Rules

- Full and Final Settlement

Pricing

To know the pricing of Ramco payroll software contact its sales team.

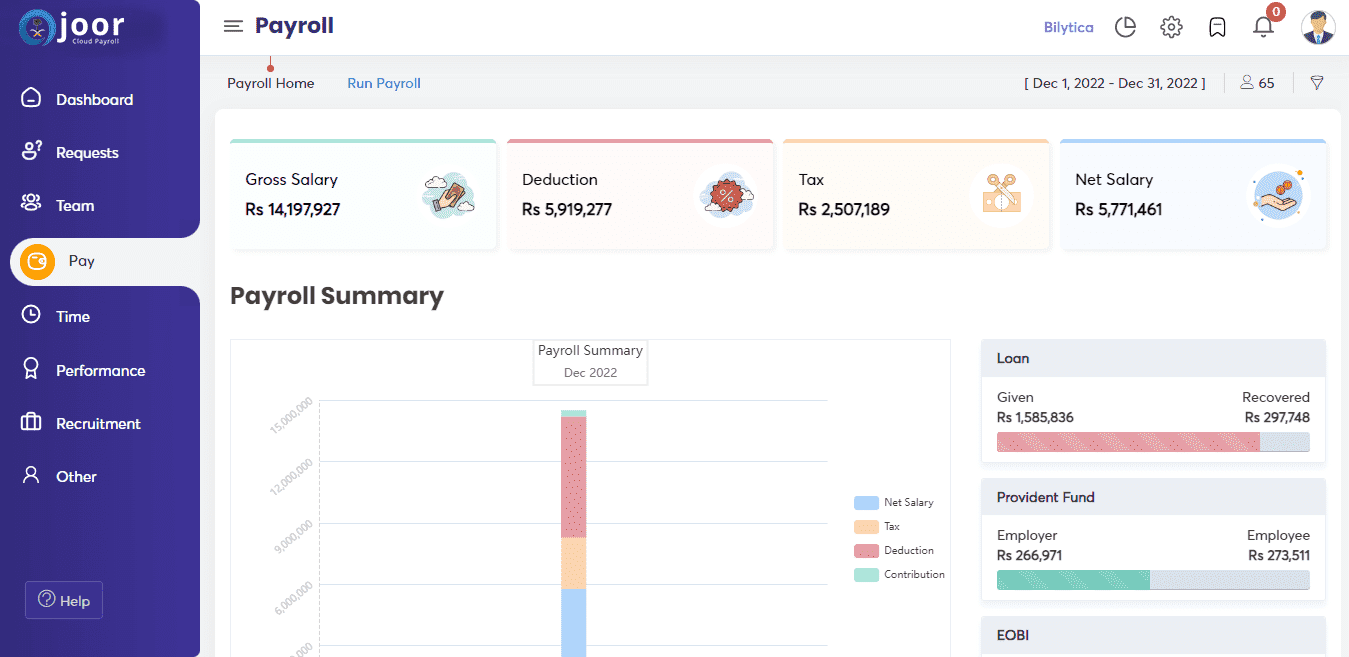

Ojoor is a cloud-based software that makes payroll more streamlined and dependable for Saudi organizations. The goals of this software are to ensure accuracy throughout the process, expedite processes, and remove administrative duties.

This payroll software is committed to offering simple user interfaces and first-rate assistance so that organizations can optimize efficiency and concentrate on what’s truly important—promoting innovation and success in their particular industries.

Key Features

- Payroll processing

- Payroll integrations

- Compliant with laws

- Employee Self Service

- Payout

- TDS calculation

Pricing

To know the pricing of Ojoor software connect with its sales team.

Conclusion

In Saudi Arabia, managing an employee’s payroll procedure can be somewhat difficult. Handling such complex compliances and business policies increases the likelihood of human mistakes in salary calculations. This will result in conflict within the employee and organizations may result from this.

By choosing payroll software in Saudi Arabia, you can stay away from all of these issues. By selecting Zimyo, your organization will be partnered with a payroll solutions provider that has over 2000 satisfied clients worldwide. This top-tier, well-recognized platform offers HR professionals a smooth way to handle the challenges of processing payroll.

With just five clicks, our software’s advanced features and user-friendly interface guarantee error-free payroll management. This allows businesses to concentrate on their strategic goals while Zimyo takes care of the rest.

FAQs (Frequently Asked Questions)

Payroll processing in Saudi Arabia is automated, ensuring compliance with local labor standards, such as the Wage Protection System (WPS), and automating wage computations and disbursements. It keeps the required payroll records current and guarantees correct, timely payouts.

Examine the payroll software’s ease of use, integration options, legal compliance, user reviews, and customer services to determine which option best suits your organization’s needs and financial constraints.

In the United Arab Emirates, many vendors offer payroll software. Payroll software such as Zimyo, Bayzat, GulfHR, and Palm.HR are among the best.