Ever wondered what CTC in salary means? Whether you’re a job seeker, a fresh graduate, or someone looking to understand their paycheck better, CTC is a term you should know. CTC stands for Cost to Company, and it’s a crucial concept in the corporate world. This guide will walk you through what CTC is, its components, and how it impacts your earnings. Let’s understand!

What is CTC in Salary?

When we talk about CTC in salary, we are referring to the overall financial commitment a company makes towards an employee. This includes:

- Basic Pay

- Allowances

- Bonuses

- Perks and Benefits

It’s an all-inclusive figure that reflects the total cost of hiring and retaining an employee, both in terms of direct salary and additional perks.

What is CTC?

CTC stands for Cost to Company. It refers to the total amount a company spends on an employee in a year. This includes not only the basic salary but also a wide range of other benefits and contributions, such as allowances, insurance, bonuses, and retirement benefits. Understanding CTC helps you get a clear picture of your total salary package and all the perks that come with it.

Constituents of CTC

CTC includes various components, both direct and indirect, that contribute to the overall cost. The components of CTC typically are:

1. Basic Salary: The fundamental part of the salary, usually 35-50% of the CTC.

2. Allowances:

- House Rent Allowance (HRA): A stipend provided to employees to meet housing rent expenses.

- Dearness Allowance (DA): An allowance given to cope with inflation and the cost of living.

- Conveyance Allowance: Compensation for travel expenses between home and workplace.

- Medical Allowance: Reimbursement for medical expenses.

- Special Allowance: Any other allowances specified by the employer.

3. Bonuses and Incentives:

- Performance Bonus: Based on individual or company performance.

- Annual Bonus: Often a percentage of the annual salary.

- Sales Incentives: For employees in sales roles, based on sales performance.

4. Benefits:

- Health Insurance: Coverage provided by the employer for medical expenses.

- Life Insurance: Coverage provided in case of the employee’s death.

- Retirement Benefits: Contributions to retirement funds like the Employee Provident Fund (EPF) or National Pension Scheme (NPS).

5. Perquisites:

- Company Car: Provision of a vehicle for personal and professional use.

- Accommodation: Company-provided housing or housing rent reimbursement.

- Meal Vouchers/Coupons: For meals and refreshments.

6. Gratuity:

A lump-sum payment made to an employee at the end of their tenure, provided they have completed a minimum number of years with the company (typically five years in many countries).

7. Provident Fund (PF) Contributions:

Both employer and employee contributions to a government-mandated retirement savings scheme.

8. Leave Travel Allowance (LTA):

Reimbursement for travel expenses incurred during holidays.

9. Stock Options: Offering employees the opportunity to buy company shares at a later date at a predetermined price.

10. Education Allowance: Reimbursement for the educational expenses of the employee’s children.

These components can vary based on the company’s policies, the employee’s role, and the country of employment.

Categorisation of the Components of CTC

1. Direct Benefits

Direct benefits in CTC include your basic salary, house rent allowance (HRA), and other cash components that you receive monthly. These are the amounts that are directly credited to your bank account and form a significant part of your CTC.

2. Indirect Benefits

Indirect benefits are non-cash components included in your CTC. These can be health insurance, company car, meal coupons, and any other perks provided by the employer. Although you don’t receive these benefits in cash, they add substantial value to your overall compensation.

3. Saving Contributions

Savings contributions are another critical part of CTC. This includes contributions to your provident fund (PF), gratuity, and other retirement benefits. These contributions might not be immediately available to you, but they ensure long-term financial security.

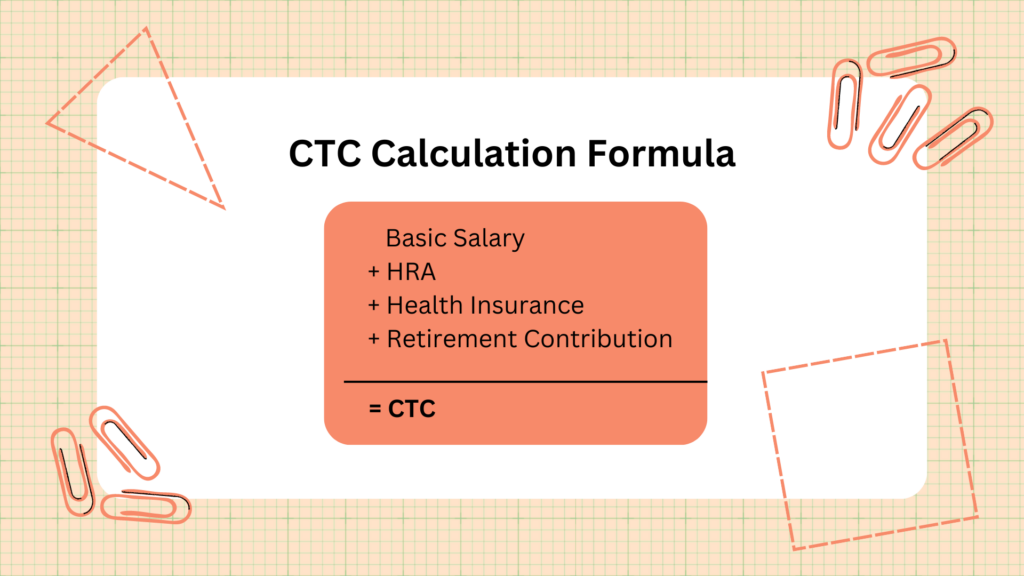

How to Calculate CTC?

Calculating CTC can seem daunting, but it’s quite straightforward once you understand the components. Add your basic salary, allowances, bonuses, and indirect benefits to get your total CTC.

An Example of CTC Calculation

Let’s say your basic salary is ₹3,200,000 per year. You receive a house rent allowance (HRA) of ₹800,000, health insurance worth ₹240,000, and a retirement contribution ₹400,000. Your CTC would be:

CTC = Basic Salary + HRA + Health Insurance + Retirement Contribution

CTC = ₹3,200,000 + ₹800,000 + ₹240,000 + ₹400,000 = ₹4,640,000

Know Your Salary and Its Components Through a Salary Calculator

A salary calculator can be a handy tool to understand your CTC better. By entering your salary components, you can get a detailed breakdown of your CTC, helping you to understand what each component contributes to your overall compensation.

Now-a-days, a diverse range of salary calculators are available. To name a few prominent ones; take-home salary calculators and income tax calculators are mostly used.

What is the Difference Between Gross Salary and CTC?

Gross salary is the amount you receive before deductions like taxes and provident fund. It includes your basic pay and allowances. However, CTC goes beyond the gross salary. It includes the indirect benefits and savings contributions as well. Thus, while your gross salary forms a part of your CTC, it’s not the entire picture.

Conclusion

Understanding CTC in salary is crucial for every professional. It gives you a broad view of what you’re truly earning and helps you make informed financial decisions. By knowing the components of your CTC, you can better negotiate your salary and benefits, ensuring you get the most out of your employment package. So, the next time you see the term CTC, you’ll know exactly what it entails and how it affects your overall compensation.

Frequently Asked Questions (FAQs)

CTC stands for Cost to Company. It is the total cost incurred by any organization on a particular amount.

Take home salary refers to the net amount received by an employee after all the deductions, taxes and benefits while CTC includes the spending by an employer on a particular employee and it includes allowances and deductions.

CTC includes number of components such as basic salary, HRA, Medical allowance, EPF contribution etc.

More from Zimyo

Salary structure in India What is Comp Off and how to apply for it?